As the latest sign that the economy is slowing down, the once red-hot housing market is starting to sputter. Based on data released this morning, only 5.41 million existing homes were sold in the US in May, which is 3.4% lower than the prior month and 8.6% lower than the... read more →

Jun

21

Jun

14

There are a wide range of investment outsourcing options available to advisors these days. Undoubtedly, the right one is out there for you and your clients. But why outsource? Findings from a recent survey of advisors by AssetMark best sum up what we have been saying for years: “To achieve... read more →

Jun

09

It seems like no one is talking about the yield curve any more. During the last week of March, when the 10-2 year treasury spread inverted very briefly, roughly 3,800 news articles mentioning the yield curve appeared on Bloomberg (and we wrote our fair share on the subject). Last week,... read more →

May

23

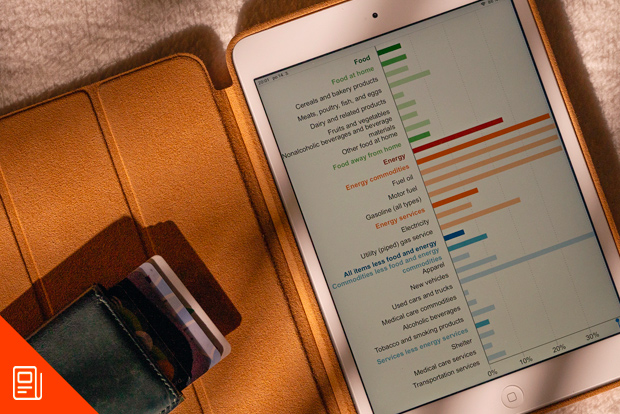

Stocks may not be cheap but they are definitely not expensive anymore. Great companies are still growing earnings; in fact, S&P 500 earnings are UP 6.5% year to date! But investors were willing to pay significantly more for those earnings last year than right now. Price multiples (commonly referred to... read more →