Economist Milton Friedman and I have many things in common,. We both believe that inflation is driven by the excess supply of money. More dollars chasing the same amount of units. After that, our similarities sort of fall off a cliff. Like him winning the Nobel Prize and, well, me not winning that….yet. I digress.

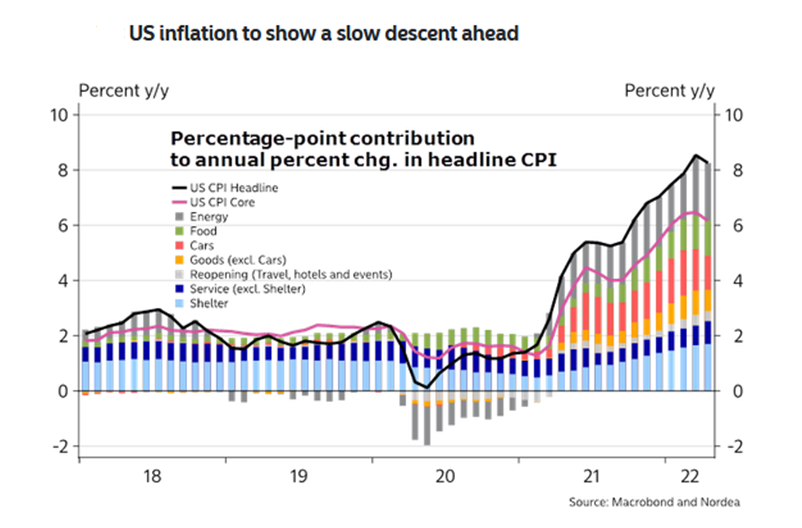

Energy prices up a lot, food prices up a lot, cars/microchip prices up a lot, shelter prices up a lot. The Fed cannot control supply but can support or destroy demand as it sees fit. The next six months will be all about how the Fed destroys demand in a thoughtful, prudent, reasonable fashion. Demand lower, inflation lower, yields lower = “soft landing”. The market has the Fed playing catch-up but thoughtful demand destruction is clearly the #1 priority of the Fed from now til Sept/Oct.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.