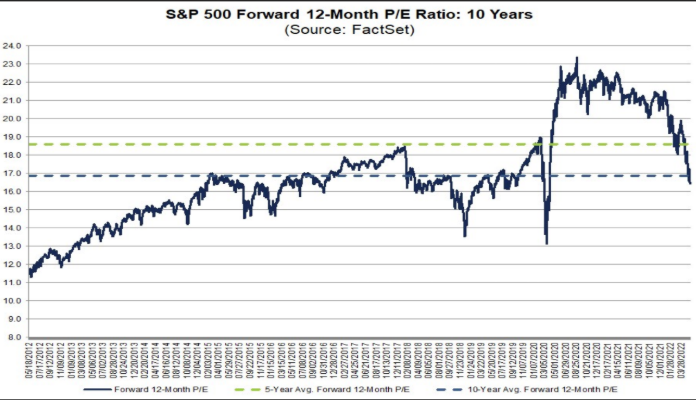

Stocks may not be cheap but they are definitely not expensive anymore. Great companies are still growing earnings; in fact, S&P 500 earnings are UP 6.5% year to date! But investors were willing to pay significantly more for those earnings last year than right now. Price multiples (commonly referred to as the Price to Earnings Ratio as pictured below) have dropped from 21.5 at the end of 2021 to 16 according to FactSet. This is below the 10-year average for valuations and very close to the 25-year average. The 2022 stock market has been dominated by the great valuation re-set.

This makes a ton of sense to us from an historical perspective but more importantly a current macro perspective. Post-recession bull markets are characterized by soaring multiples as investors expect the economy to roar back to life and earnings along with it. After a year or two, the Federal Reserve starts to tighten monetary policy by raising interest rates, and investors begin to become more cautious by paying less for earnings. In recently history this drop in multiples, or valuation re-set, occurred in 2004 and 2011 and the drawdowns in stocks as a result were a temporary pause in an otherwise strong bull market. This year we add an extra special treat with very, very high inflation which is causing the Federal Reserve to contemplate a much more aggressive tightening cycle. Add to that the fog of war, energy concerns, supply chain issues, China COVID disruptions, etc… Uncertainty in the future is very high and many are wondering if we are heading into a recession.

Is this a mid-cycle valuation re-set and investors will start to reward growing earnings? Or are we heading into recession with a falling economy taking earnings with it? We continue to monitor all data for the latter as recession probabilities are slightly higher but for now invest for the former. Avoiding junky companies with no earnings, or even just incredibly expensive companies, has been a winning strategy for us this year. Some stocks have started to come on sale, but we are in patience mode now.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.