2020 was about COVID and the scientific search for a vaccine. 2021 was about quasi-reopening of the global economy and too much fiscal and monetary stimulus here in the USA (probably in the neighborhood of $3 trillion too much). 2022 was about inflation and the Fed getting too far behind both inflation and the market. And early 2023 is about a slowing economy and the timing of a recession…it’s a comin’.

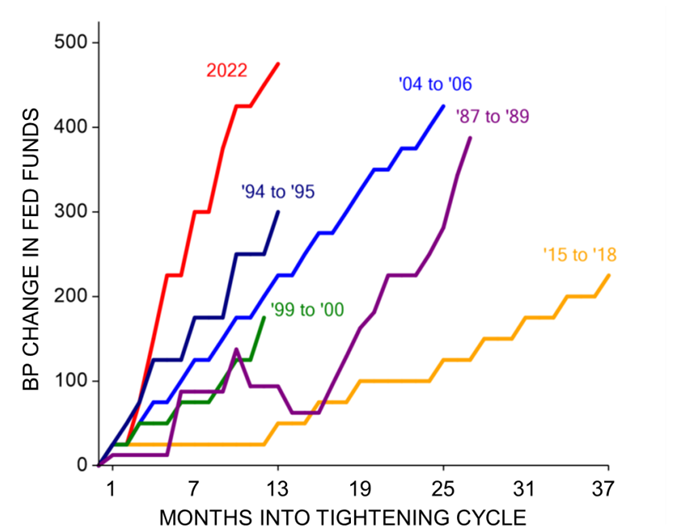

In some of my recent notes I have talked about the Fed “jamming on the brakes” in their attempt to reverse inflationary trends and slow a much-too-hot economy via rate hikes. The chart below captures this brake jamming perfectly. Over the past 40 years there have been six rate hiking cycles. The 2022 rate hiking cycle has distinguished itself by being both the biggest and the fastest. Brake jamming at its finest.

You cannot have a line like the red line below and not leave a big wake behind. FTX and crypto trading platforms RIP. Market favorites of the Summer of 2021, like FinTech SPACs and meme day-trading darlings (AMC Entertainment and GameStop), also RIP. SVB and First Signature are the recent noted casualties. You cannot jam on the brakes like the Fed has just jammed on the brakes and not have residual fallout. Money supply growth is cratering, inflation is falling, and the economy is weakening. We are going to have a recession, likely this summer. Not a newsflash to our regular viewers. Commercial real estate (especially office RE) and high yield debt are about to experience an unpleasant drawdown and likely some form of permanent impairment. These are both areas that need to be avoided.

Source: Federal Reserve and EISI as of March 31, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.