Our internal recession model has been flashing red for a while, and although lots of progress has been made vs. inflation the US economy has held up very, very while. Double checking our model here against a well-proven external source: the Senior Lending Officer Opinion Survey.

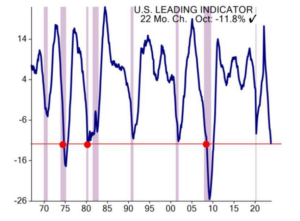

The survey of leading economic indicators (LEI for short) is flashing “recession” and this shouldn’t be ignored. Over the past 50 years, the LEI data has retreated by at least-10% only five other times and each of those were accompanied by recession. Over the past 18 months, the LEI has now fallen by -11%……we’ve got our sixth time now. I think we’ll find out in March 2024 that the US economy was actually in recession in December 2023.

The recent fall in UST yields is consistent with this view, as is the growing market consensus that the Fed rate hiking cycle is now complete. Recessions are normal parts of economic cycles. Expect the unemployment rate to continue to rise and the Fed to continue to “pause” on rates. Stay away from traditional high yield credit. It’s not cheap enough yet and that’s where all the bond defaults will happen when economic slowing actually morphs into economic stopping. Overweight quality and enjoy today’s 5% risk free rates because I don’t think they will be at this level in 6-12 months. I believe that next Fed move will be in mid-2024 and it’ll be a rate cut, not a rate hike.

Source: EISI as of November 20, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.