Over the next couple of weeks, our Investment Team will be rolling out and sharing our thoughts on more longer-term market themes. Quarterly earnings data, monthly non-farm payroll numbers, and what Fed chair Powell either said or didn’t say are all important things to focus on as we build and manage client portfolios. The day-to-day stuff matters greatly, but much can also be gained by reflecting on other important themes that develop more quietly, matter over longer periods of time but often don’t get much current airtime. In that spirit, today we’re sharing our thoughts on the shrinking number of public companies available in which to invest here in the USA.

Twenty-five years ago, there were approximately 7200 publicly traded companies here in the US of all shapes, sectors, and sizes. Today that number has shrunk to approximately 4200 and it’s trending lower. 25 years of mergers, acquisitions, bankruptcies, LBOs etc., etc. has shrunken the investible universe of public companies by 40%. Bigger companies to be sure, with much larger market capitalizations, but certainly fewer investible opportunities in terms of absolute numbers. Twenty-five years ago, you also didn’t need to compete with ETFs for access and liquidity to available shares, but that’s another theme for another day.

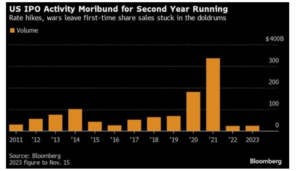

It is clear as it relates to going public or staying private, more companies are choosing to stay private for longer. It is not uncommon to see private companies carry an implied $50 billion market cap while they are still private. Why are they doing this? No doubt a combination of many factors but a few look like a desire by private boards to be less regulated/scrutinized than their public brethren, the development of the mega-sized private equity funds, and perhaps even management’s desire not to have to focus and discuss each and every quarterly result (even though they still do when they are private). And this trend is unlikely to change as fewer companies are IPO’ing (initial public offerings). There was a small spike in IPOs in 2020 and 2021 when life was good, speculation raged and money cost nothing. That small IPO spike is now gone. The trend of “private for longer” is here to stay.

The implications for asset allocation decisions are that the multi-trillion-dollar private equity/alternative investing world cannot be ignored. Great opportunities do exist there too. Similar to our belief with regards to investing in public companies, the rules of owning quality and being diversified apply to private companies too. As we think about 2024 and beyond, however two things are clear: (1) this theme of “private for longer” isn’t going to change anytime soon, and (2) our allocations to this universe need to begin to increase further in an appropriate, thoughtful, and timely way.

Source: Bloomberg as of November 15, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.