Today marks the 3-year anniversary of the COVID market low: March 23, 2020.

Three years ago today, mankind, civilization and global markets were reeling from the onset of COVID. The daily images of illness and death were real and shocking. The global economy had been purposefully shuttered. Markets were collapsing as global central banks tried to flood the system with enough financial oxygen to keep the system afloat. To put things in perspective, the VIX volatility contracts has historically spent less than 1% of its time above the >35 level. On March 23, 2020, the VIX contract traded at 66. Things were spinning and possibly spinning out of control.

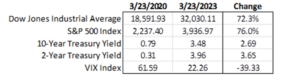

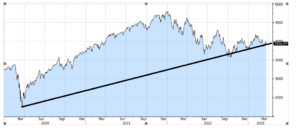

Fast forward three years, and today the SP500 stands +76% higher, and that’s after 15 months of rate hikes and persistent market volatility. Over the past three years, employment recovered, medical innovation occurred, and markets recovered. Everyone got really, really good at Zoom.

My point is that all crisis eventually ends, including the current one that involves elevated inflation and interest rate policy. This crisis will pass, and we’ll collectively move onto whatever is next. Own quality, be diversified, and recognize that time is an enormous asset when it comes to investing and compounding. Warren Buffett has always said it best: our country has endured world war, political scandal, and senseless acts of terrorism and along the way grown wealth per capita exponentially larger due to hard work and genius and innovation. WB says never bet against the USA. I agree 100%.

I hope you have a nice March 23, 2023

Source: Bloomberg data as of March 23, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.