Not a newsflash, but November 2023 was a monster month in terms of returns for most major asset classes. SP500 +9.13% for November, Barclays Aggregate Bond Index +4.55%. Massive, outsized moves which are the direct result of weak investor sentiment, poor positioning, and the realization by investors that global central banks’ battle vs. inflation is done. Markets LOVE when the Fed goes from hiking rates to pausing to maybe cutting rates next. In November 2023 we saw UST yields materially lower, the USD materially weaker, and risk assets of any size/shape rip.

It’s been a while since I borrowed David Zervos’ line about “2s and SPOOS” but that’s the playbook for 2024 and 2025, I think. We’re talking about 2s (as in 2y US Treasuries) and SPOOS (as in market slang for SP500 futures or stocks in general). 2s will follow the path of Fed policy, which to me looks like rate hiking is done, pausing is a winter activity, and rate cutting could be next sometime mid-2024. Risk assets LOVE when 2s change direction but I think that’s exactly where we are at. The rate cycle has peaked, yields head lower, and stocks beyond the Magnificent 7 (or 8) have reawakened from their 24-month slumber.

It’s about 2s heading lower in yield: Over the past 45 days, US Treasury yields have declined approximately 75-100bps. This is a major change in direction. We’ve been saying it for a while: inflation is falling everywhere, and the labor market will be the last to fall. The softening of the labor market will lead 2y UST lower, which is consistent with a peak in rate policy and a peak in UST yields. Note the 2y UST yield chart below.

Source: Bloomberg Finance LP as of December 4, 2023

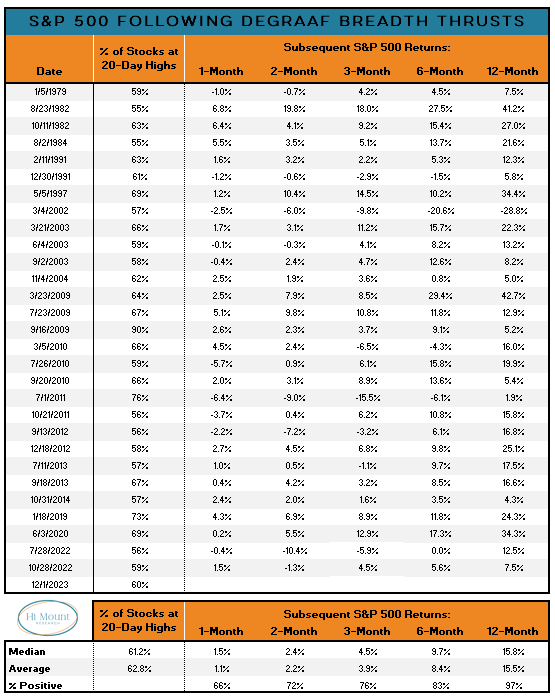

And it’s about Spoos LOVING 2s heading lower in yield: stocks (SPOOS) had a big November, but as Sean D. has been saying for a while, when the stock market experiences “thrust” (improving breadth, improving participation accompanied by a violent move higher in stock prices) it’s not a “one and done” event. “Thrust” rarely happens but when is does FORWARD RETURNS look very good/great. The DeGraaf data below looks at all “thrust” moments back 40 years. 12-month forward SP500 returns look strong to quite strong. Spoos love lower 2s.

Source: RenMAC Research as of December 7, 2023

CWM Theme #3: 2s and SPOOS offer the clues.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.