Q1 2023 earnings reporting season is officially starting next week. As usual, financials will be the first to take center stage, with none other than First Republic kicking things off on Thursday, and the big banks following over the next few days. Bank reports always get a good deal of attention because they can provide early clues as to how corporate America fared during the quarter. This time around, following the recent March Madness of bank failures, they will no doubt get even more scrutiny than usual. Of course, we will be listening closely as well to what Jamie Dimon & Co. have to say.

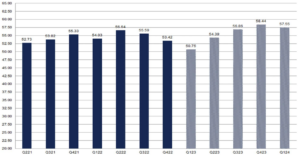

Looking at the S&P 500 index as a whole, current estimates call for earnings to come in at $50.75/share for Q1 2023, which would be 6.6% lower compared to the same quarter last year. That would make it the second consecutive quarter with YoY earnings declines, and also the largest earnings decline since Q2 2020. Throughout the quarter, analysts have been aggressively lowering their estimates, which started the year at $54.13. While it is actually common practice for analysts to lower their estimates during the course of any given quarter, a 6.3% downward revision is almost twice the average of the last 10 years. This is not surprising given how negative company guidance has been recently. Of the 106 companies that have issued guidance for Q1 2023, 79 have guided lower, which is also significantly more than the average for the last 10 years.

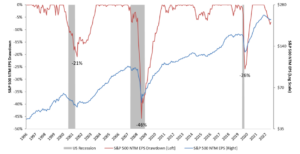

Unfortunately, given our view that the economy is on track to fall into recession sometime by mid-year, negative revisions and guidance are likely to persist for some time still. Looking beyond Q1, analysts’ estimates appear to be a bit too sanguine. The consensus currently sees $54.39/share for Q2, which would be about 4.0% lower than the same quarter last year but would imply a 7.2% quarter-on-quarter increase from Q1. That’s expected to be followed by a 4.5% increase in Q3 and another 2.8% increase in Q4, always according to consensus estimates. In other words, analysts expect earnings to bottom in Q1 and then be off to the races. If history is any guide, earnings tend to bottom either during or shortly after recessions, not before. Therefore, at a minimum, we expect estimates for Q2 and likely Q3 to be revised significantly lower. Analysts are likely just waiting for the information that will transpire from the upcoming Q1 reports to adjust their outlooks for the remainder of the year.

How much lower do we think they will have to go? From a peak-to-trough perspective, a relatively mild recession (i.e. not a depression/financial crisis/global pandemic) would imply an earnings contraction of around 15-20%. Currently, analyst estimates have fallen by about 8% from last year’s peak. The good news is that we are already halfway there. The bad news is that we are only halfway there. It will likely stay bumpy until we get there, and then it will be off to the races, not just for earnings but also for stocks.

Source: Congress Wealth Management, Bloomberg, as of 3/8/2023

Source: Congress Wealth Management, National Bureau of Economic Research, Bloomberg, as of 3/8/2023

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.