In basketball, the “triple threat” position is a stance where the player can either pass, shoot, or dribble. It’s a very athletic stance that creates options. It’s the absolute cornerstone of basketball offense.

In investing, the “triple threat” is the rare investing environment that exists when the Fed starts cutting rates, the economy is strong enough to permit earnings growth, and an equity market that is priced at a reasonable valuation/multiple. A very athletic market that creates options. Today, let’s discuss Triple Threat Part 1: rate CUTTING cycles.

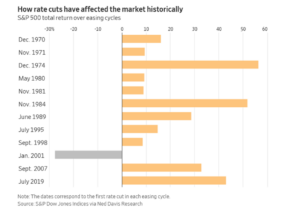

In the past 50 years, there have been a dozen times where the Fed went from hiking rates to cutting rates. The chart below captures forward equity market returns from the point at which the Fed started cutting rates. 11 of the 12 observations are positive markets and the forward returns speak for themselves. 2001 is the notable outlier and involved plenty of other factors (starting from historically high equity market multiples, a massive collapse in corporate earnings, 9/11 terrorism, and countless acts of accounting fraud (Enron, WorldCom, Adelphia Communications to name but a few). But we look at it all so 2001 needs to be counted too.

The bigger point is markets LOVE when the Fed goes from “hiking to pausing to cutting” and we believe that’s where we are and where we’re heading in 2024. The cost of debt goes down and the price of stocks generally goes up. Not everything is a smooth ride but the commencement of a rate cutting cycle cannot be overlooked and one is about to start come this spring. History says markets will love it.

Source: S&P Down Jones Indices via Ned Davis Research as of January 15, 2024

Richard Barrett

Chief Investment Officer

CW Advisors LLC (“CWA”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at cwadvisorsgroup.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. CWA believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on CWA’s research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.