Despite overwhelmingly bearish investor sentiment (or perhaps because of it), the S&P 500 index managed to rally 4.75% last week (and tacked on another 1.19% yesterday). What is perhaps even more impressive is the fact that last week was only the 4th best week for the stock market so far this year (the best week so far was the last week of May, when the S&P 500 index rallied 6.62%).

While it may feel comforting to get defensive or even go to cash when things are scary, we must keep in mind that risk always goes two ways. There is the risk of experiencing losses while being invested in the market, and the risk of missing out on gains while sitting on the sidelines. However, in the former case, one may at least find consolation in the fact that he/she is still holding on to an asset that is now more attractively valued, and in the hope that paper losses may eventually turn into gains. In the latter case, once the investor is finally forced to reinvest into the market at a higher price, he/she will simply realize a permanent loss of upside potential with nothing to show for it.

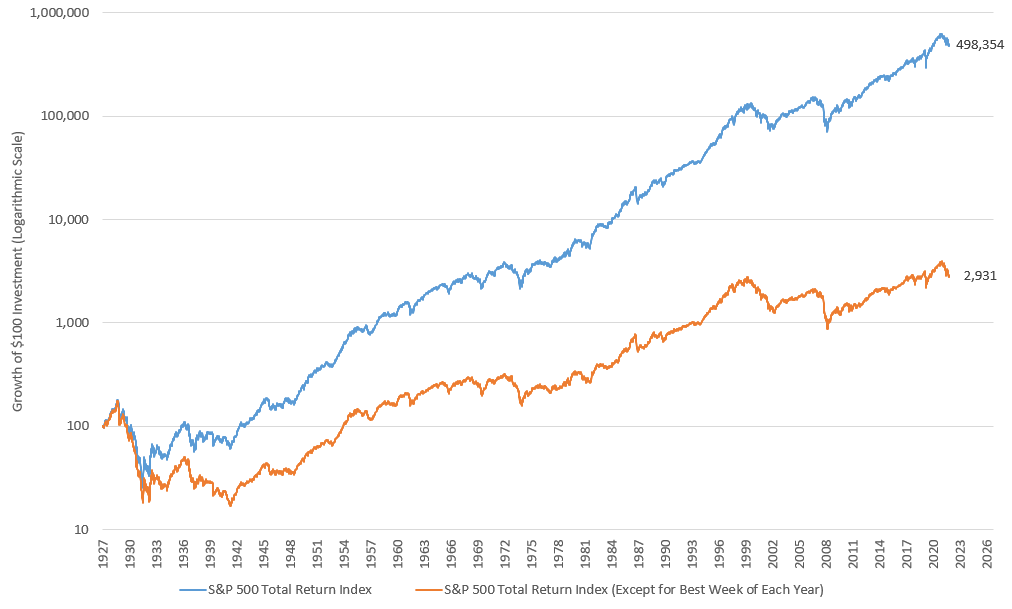

The chart below gives us a feel for how important it is not to miss out on weeks like last week. The blue line represents the performance of the S&P 500 total return index since 1927 (the earliest available on Bloomberg), while the orange line measures the performance of a portfolio that invests in the S&P 500 index but misses out on the best week of each year by sitting in cash. While the S&P 500 index returned 9.4%/year over this period, such a portfolio would have returned only 3.6%/year. In other words, being out of the market less than 2% of the time (1 out of 52 weeks in a year) would have cost the portfolio almost two-thirds of the potential return. Over this nearly 100-year period, such a difference in annual return would have compounded immensely: a $100 investment in the S&P 500 index in 1927 would have grown to $498k, while the portfolio would have grown to just under $3K.

Please keep these numbers in mind if and when you are considering making a drastic change to your portfolio allocation, such as going to cash.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.