Roughly 20% of companies in the S&P 500 index have reported Q3 results as of this morning. So far, the financial sector has taken center stage, with all the big banks reporting over the last week or so. Those reports were followed by investors very closely, as banks, more than any other business, are able to keep their fingers on the pulse of the economy. The results were better than expected, with earnings for the sector coming in 5.4% higher than estimated. The common thread from those reports: surprisingly resilient levels of borrowing and credit card spending by consumers, at a time when higher interest rates are boosting net interest margins. Still, banks were cautious in their outlook going forward, and are setting aside large amounts of money as provisions against future losses, which is artificially weighing on current earnings. However, should future losses end up being smaller than estimated, those provisions will be released and provide a boost to future earnings (which is what happened after COVID). On the investment banking side, a collapse in advisory fees, as companies are steering clear of dealmaking and capital markets due to heightened volatility and uncertainty, was offset by strong trading revenue.

Looking at the S&P 500 index as a whole, results reported so far indicate that top line growth remains healthy, with sales coming in 7.3% higher than last quarter and 1.2% better than expected. Revenue growth for the corporate sector is tightly linked to nominal economic growth, which is the sum of real economic growth and inflation. So, at a time when real GDP growth has been slowing down, sales are still getting a boost from higher inflation. The key for investors going forward will be whether earnings can also keep up with inflation, or whether rising input costs will finally begin to bite and cause profit margins to fall. What we are seeing so far this quarter is that earnings are not quite keeping pace with sales, dropping by 1.8% compared to last quarter, which implies a decline in profit margins. However, the good news is that such a decline was much smaller than feared, as earnings came in 4.5% higher than expected. Profit margins have actually been trending lower for a couple of quarters now, after peaking at an all-time high earlier this year. While a normalization towards more sustainable levels is to a certain extent expected, a more significant decline would be an unwelcome development.

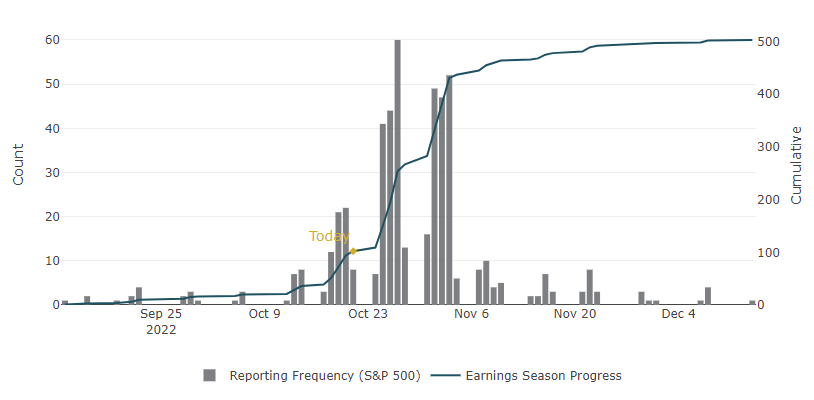

Next week will be the busiest week of the season, with 166 companies or 27% of the market capitalization of the S&P 500 index reporting results. This will include some of the biggest companies in the index such as Microsoft, Alphabet, Apple and Amazon. By the end of next week, we will have received reports from more than 50% of the market capitalization of the index, and we will have a better feel for how corporate America fared in Q3, and what to expect going forward.

Profit Margins Declining from All-time Highs

A Busy Week Ahead

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.