Inter-market relationships have been much more important for stocks than in past years. I have been highlighting in meetings, and most recently in the quarterly investment call, that the US Dollar is one of the key relationships for the direction of stocks. You can see it in the charts!

The reason for a strong dollar is straightforward as the U.S. is the strongest economy in the world right now, and the US Dollar is one of the safest investments this year. As global investors seek to avoid risks in China, Japan, Europe, and the U.K. this pushes the dollar higher. Additionally, the Federal Reserve is much more aggressive with interest rate hikes to combat inflation further supporting the dollar. Ultimately stocks feel this pressure as large multi-national companies could see meaningful revenue decline.

So, we believe a declining dollar is a major key to reversing the downtrend in stocks. As marked by the red lines on the following two charts, when the dollar falls, we have gotten countertrend moves higher in the S&P 500.

The bad news is the US Dollar is in strong uptrend, and S&P 500 is in a downtrend. Each move in the dollar lower is halted at the 50-day moving average, and it continues to rise with stocks falling to new lows.

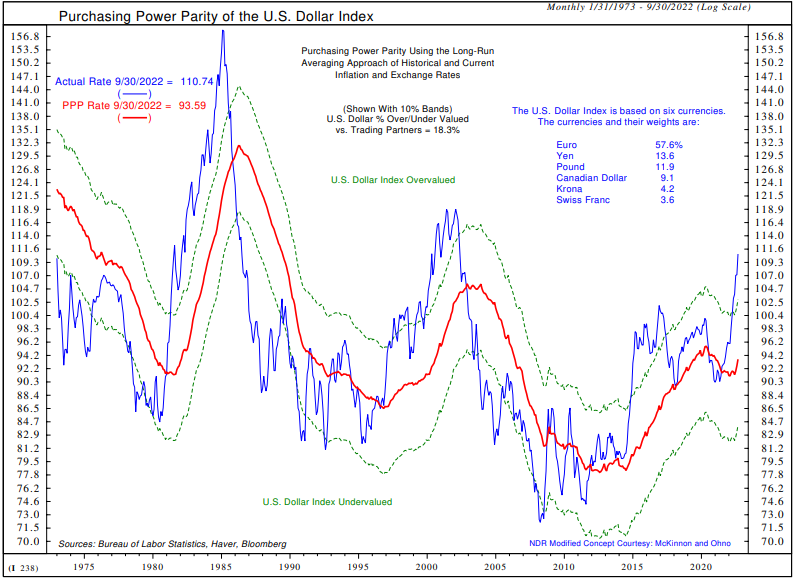

The good news is that a rising dollar is one mechanism to slow inflation which will ultimately lead to a pause in Federal Reserve interest rate hikes. This is still in the future, but we are moving closer and closer to this point. There is tremendous pent-up energy for a lower dollar when this occurs. It is currently over-valued by 18.3% as measured by purchasing power parity and that energy should transfer to stocks.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.