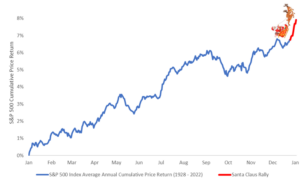

The Santa Claus rally is a well-documented seasonal anomaly that sees the stock market produce abnormally high returns around the Christmas holiday. The term was coined in 1972 by Yale Hirsch, founder of the Stock Trader’s Almanac. In his original definition, the rally covered the period between Christmas day and January 2nd of the following year. Based on historical stock market data since 1928, the S&P 500 index has gained a jolly 1.09% on average over that 9-day stretch, with a positive return in 71.6% of occurrences. When compared with any other 9-day stretch throughout the year, the Santa Claus rally period is the one with the highest average return. The chart below plots the average path of the S&P 500 index throughout the calendar year, with the section of the line highlighted in red representing the Santa Claus rally.

Source: Congress Wealth Management, Bloomberg, as of 12/19/2023

Several explanations have been offered as a justification for the existence of the Santa Claus rally, some more convincing than others:

- Increased investor optimism fueled by the holiday spirit.

- The investment of year-end bonuses into the stock market.

- Vacationing professional investors leave the market in the hands of retail investors, who tend to be more bullish.

- Increased consumer spending due to holiday shopping, which boosts company earnings and therefore stock prices.

- Santa is real, and he has decided that lifting the stock market is an easier way to deliver gifts than climbing down people’s chimneys.

Whatever the reason behind the Santa Claus rally, it appears Santa has decided to show up early this year. The chart below plots the average path of the S&P 500 index between 1928 and 2022 (in blue, same as above) against its 2023 path so far (in green). The magnitude of the moves is different (thus the different scales), but the path of the market this year resembles its historical average very closely. Moreover, the stock market rally we have witnessed over the last couple of weeks bears a striking resemblance to the Santa Claus rally, albeit a few weeks earlier than usual. Of course, this time around we know exactly what caused the rally: the role of Santa Claus was played by Fed Chair Jerome Powell, and the gifts were a confirmation that the Fed is on pause, and the promise of rate cuts next year. Ho, ho, ho!

Source: Congress Wealth Management, Bloomberg, as of 12/19/2023

So, was that it? After such a strong move, is the market due for a period of consolidation? Or should we expect the holiday spirit to keep the rally going into the new year? I would leave out some milk and cookies just in case.

The CWM Investment Team would like to wish everyone happy holidays and a joyful new year.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.