As we approach the turn of the calendar, we take a look back at how S&P 500 earnings fared this year, and a look ahead at what is in store for next year. The chart below shows the earnings growth rate estimates for both 2023 and 2024, for the S&P 500 as a whole (in red) as well as for each sector (in blue).

After contracting in the first half of the year and expanding in the second half of the year, S&P 500 earnings are expected to end the year roughly unchanged (or up only 0.7%) from the prior year. Underneath the surface, however, different sectors of the index saw wildly divergent earnings fortunes during the year. At one end of the spectrum, consumer discretionary and communication services saw their earnings grow by 43.7% and 23.4% respectively, benefiting from a relentless consumer as well as from a renewed focus on efficiency. Meanwhile, at the opposite end of the spectrum, energy, materials, and healthcare all saw their earnings fall by more than 20%. The decline in oil and other commodity prices weighed heavily on energy and materials, while healthcare suffered from tough comps due to waning demand for COVID-19 vaccines, tests and PPE.

Looking ahead, S&P 500 earnings growth is expected to maintain the accelerating trend we have seen since Q3 of this year and achieve a brisk 11.8% growth rate in 2024. Such improved growth rate is expected to result from both accelerating sales growth (from 2.3% to 5.5%) and from a widening of profit margins (from 11.7% to 12.3%). From a sector perspective, health care, technology and communications are expected to lead the charge with earnings growth in the high teens. On the other end of the spectrum, real estate, materials and energy are expected to lag behind, with earnings growth in the low single digits.

Source: Congress Wealth Management, FactSet Research, as of 12/8/2023

The chart below makes it easier to see which sectors are expected to experience stronger versus weaker earnings growth in 2024 compared to 2023, by highlighting the difference in growth rates. The “most improved” title would have to go to healthcare, which is expected to see its earnings growth rate accelerate by nearly 40% (from -20.8% to 19.1%). Easier comps and the weight-loss drug craze are two big factors behind the expected shift in fortunes for the sector. Not too far behind healthcare we find energy and materials, also 2023 laggards seeking redemption. Results for these two sectors are highly dependent on oil and other commodity prices, and an expected stabilization in these markets after a tumultuous 2023 should help these sectors regain their footing. At the opposite end of the spectrum, consumer discretionary stands out, with an expected deceleration of over 30% (from 43.7% to a still healthy 12.6%). After a blockbuster year for consumer spending, the sector is facing a consumer that is leaving the “YOLO” post-pandemic years behind and is being forced to turn more savvy by dwindling excess savings and higher interest rates.

Source: Congress Wealth Management, FactSet Research, as of 12/8/2023

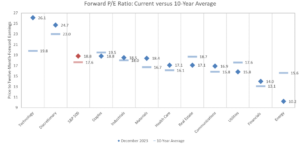

Combining earnings expectations with current valuations helps us see where opportunities might lie going forward. The chart below plots the current price-to-forward earnings ratio for the S&P 500 index and its sectors and compares it to the 10-year average for each. For the S&P 500 as a whole, the current multiple stands at 18.8, which is only slightly above its 10-year average of 17.6. Not cheap, but also not overly expensive. At the sector level, technology and consumer discretionary stand out not only for sporting the two highest multiples by far, but also for being significantly above their respective 10-year averages. Consumer discretionary in particular appears vulnerable in light of the expected severe slowdown in its earnings growth. At the opposite end of the spectrum, we find energy with a multiple of 10.2, which is not only the lowest by far, but also the one that is undershooting its 10-year average by the most. If the sector manages to return to positive earnings growth in 2024, as expected, then its current multiple seems much too low.

Source: Congress Wealth Management, FactSet Research, as of 12/8/2023

All in all, 2024 should provide a much more benign earnings environment for the stock market as a whole. However, diverging outlooks at the sector level should offer significant opportunities for outperformance.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.