With over 90% of companies in the S&P 500 index having already reported results, the numbers for Q3 earnings season are effectively in. Here are the main takeaways:

- Results were stronger than expected.

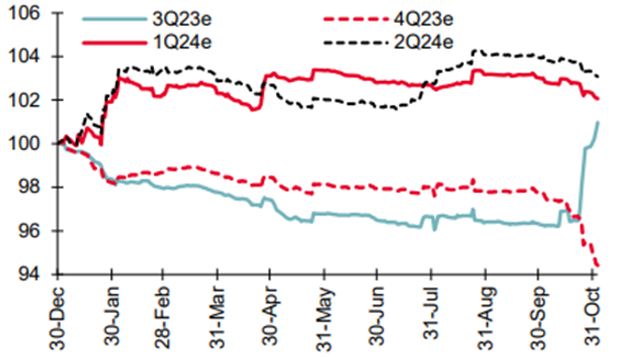

On September 30th, before reporting kicked off, Q3 earnings were expected to decline by -0.3% compared to the prior year. This would have marked the fourth consecutive quarter of year-over-year earnings declines, a stretch that began with Q4 2022. However, results so far have been much stronger than expected, so much so that Q3 earnings are now on track to grow by +3.9% compared to the same quarter last year. The main factors behind these positive earnings surprises were (1) a stronger than expected economy during the quarter, led by solid consumer spending, and (2) cost-cutting measures being put in place over the last few quarters beginning to bear fruit and resulting in widening profit margins. - Guidance was weaker than expected.

While companies were delivering the good news about last quarter’s results, they were also striking a cautious note for the current quarter. Out of the 75 companies that formally issued guidance for Q4 earnings, 64% issued negative guidance, which is significantly above the 59% average of the last five years. As a result, analysts have had to scramble to lower their Q4 estimates, which are currently down roughly 4% from where they were on September 30th. This is partly what is behind the market’s lukewarm reaction to what would otherwise be a solid quarter for earnings. - Outlook for 2024 remains positive.

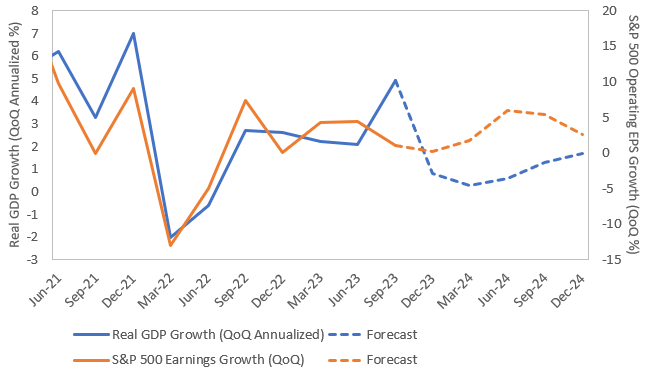

Notwithstanding the recent downgrades of earnings estimates for Q4, the outlook for 2024 remains bright. Q3 2023 is now expected to be the quarter that kicks off an earnings expansion that should carry us at least through the end of next year. More specifically, earnings growth is expected to remain at around 4% in Q4 2023, before accelerating to 7% in Q1, 10% in Q2 and Q3, and 16% in Q4 2024. This may seem at odds with consensus forecasts pointing to an economic slowdown starting as soon as Q4 2023 and lasting through the first half of 2024. However, while earnings and the economy tend to follow the same path in the long term, it is not uncommon for them to decouple in the short term. Just like 2023 so far has been characterized by a strong economy and relatively weak earnings growth, 2024 could see them trade places. What could cause earnings to outperform the economy going forward? For one, the US economy is more leveraged to the service sector (which may be slowing down), while corporate earnings are more leveraged to the goods sector (which is reaccelerating). And the already-mentioned cost-cutting measures that companies have been putting in place this year should continue to pay dividends next year.

Q3 came in higher, but Q4 is being revised lower

Source: SocGen, as of 11/8/2023

Diverging forecasts for economy and earnings

Source: Bureau of Economic Research, S&P Dow Jones Indices, Bloomberg, as of 11/9/2023

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.