Tuesday’s market meltdown of -4% off a bad CPI print warrants both comment and context.

Here goes.

Since 1950, the market has gone down -4% in a single day 53 times. That’s 53 times out of a total of approximately 17,400 trading days. The market’s reaction Wednesday to a bad CPI print was oversized to the downside, undoing the rally of the past week. On Wednesday, 95% of the SP500 was lower in price. That rarely happens. On Wednesday, 100% of The Nasdaq was lower in price. That never happens. NEVER.

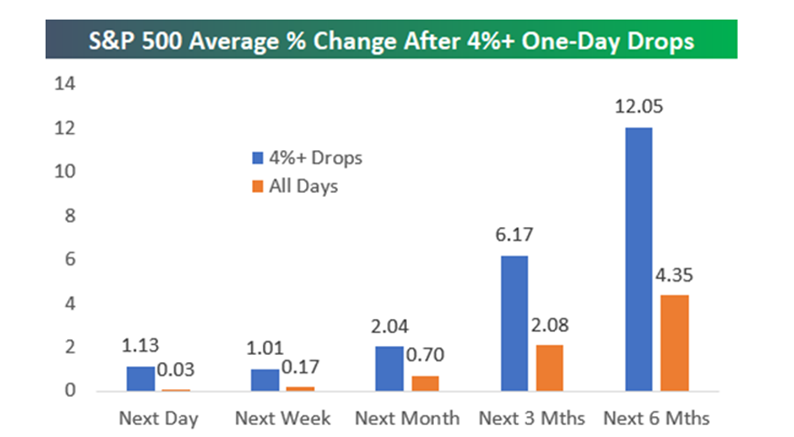

When 90-100% of stocks go down in a single day, its symptomatic of “bottoming”. 3900 remains a major level in which the SP500 must hold…but…we’ve looked at all the other times in which the market had similar flushings in the past 72 years – forward returns six months out look solid. Please reference data below.

Prices are elevated but actually going down. Tighter financial conditions and higher rates are causing such. Lumber, oil, gasoline, iron ore prices all down 20-60% in the past six months. Rent is stubbornly high but wages look tired and wanting to roll over. Rent can’t keep going up without wage growth. The next demand destruction to watch is in the labor market and such will likely happen this fall. A softening of the labor market will coincide with the Fed pausing on additional rate hikes. That moment will be the “all clear signal” for risk assets, especially now re-valued US stocks. Hold the line.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.