Economic demand destruction well underway

The excessive monetary and fiscal stimulus of 2021 led to a demand spike that resulted in an inflation spike. Financial conditions have been getting tighter over the past 8 months in response to such. Higher interest rates, wider credit spreads, and a strong USD are all symptomatic of tighter financial conditions and they have all been in place for a while now. Eventually, tighter financial conditions destroy enough economic demand that inflation falls and the Fed will go from being very aggressive to being neutral when it comes to interest rates. We are in the midst of that happening right now.

The indigestion the market has had now for a few weeks is in reaction to higher yields, especially higher 10Y UST yields. 10Y UST yields have risen from 2.77% to 3.22% in a brief period and the market has had an allergic reaction to such. But economic demand is being destroyed and strangely that’s a good thing. Everywhere we look demand looks soft and prices look lower – lets take a look:

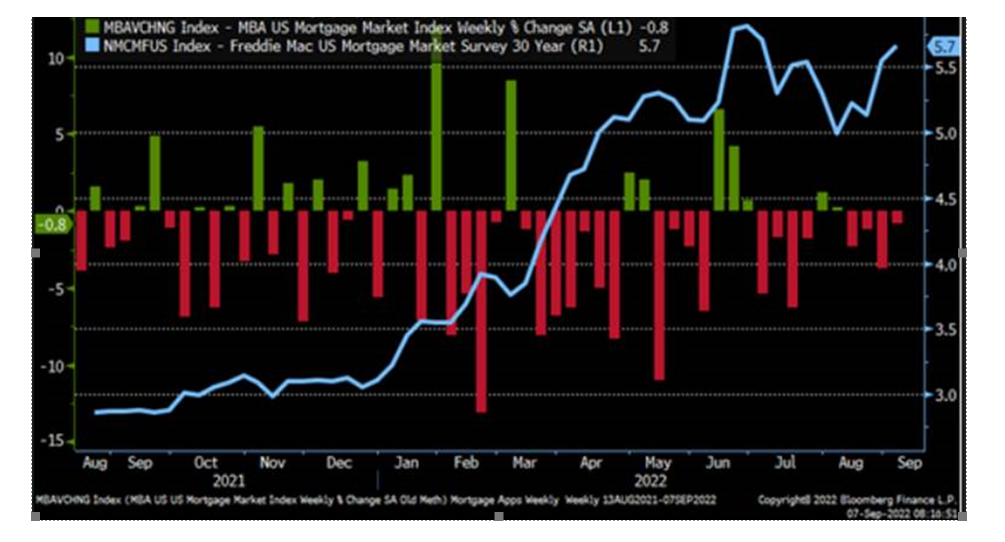

Housing and mortgage applications: Higher rates have resulted in slowing housing starts and less housing activity. Mortgage applications just fell for the 4th week in a row.

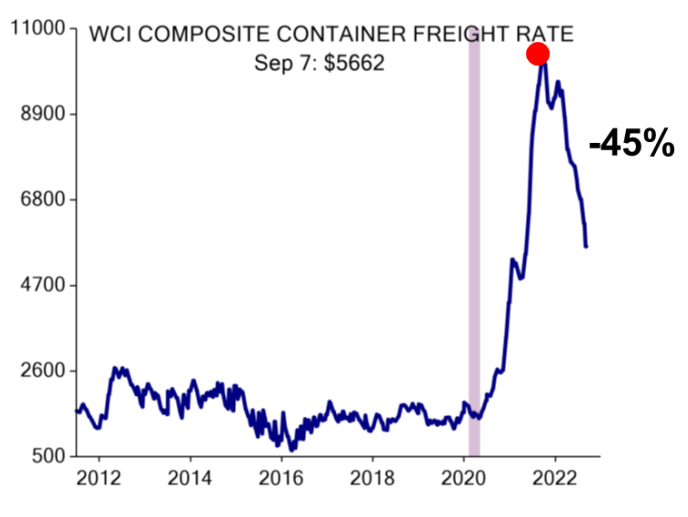

Shipping costs are plummeting: Supply chain disruptions are a thing of the past. Shipping costs and freight rates are materially lower. Demand down, price to ship down.

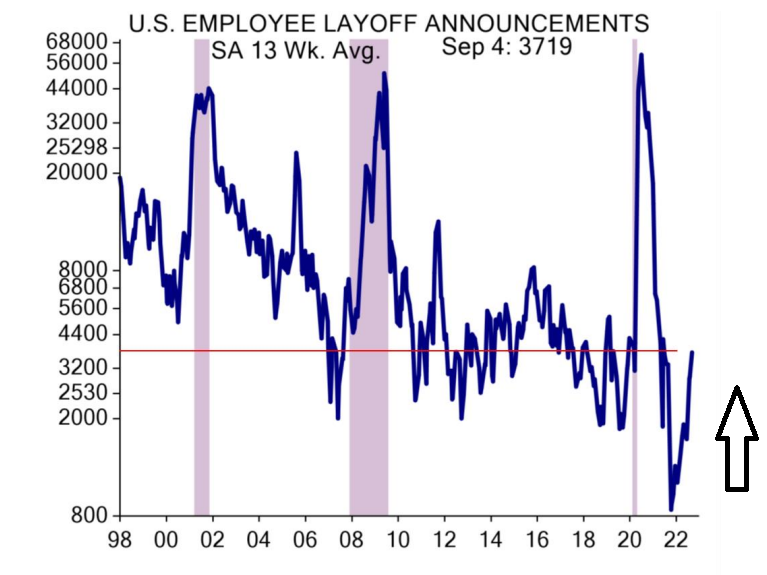

Labor demand is softening: The labor market is still tight but its definitely weakening. Average hourly earnings for August went up just .3% – well below expectations. Layoff announcements are up. The US labor market is still “missing” 4mm participants who were in the economy on March 1, 2020 when we got hit by the pandemic but have somehow disappeared. Not retirements, not illness, not extended paid time off. These 4mm tapped out and left the economy. In a strange way a recession in 2023 hopefully brings them back into the workforce – they are missed.

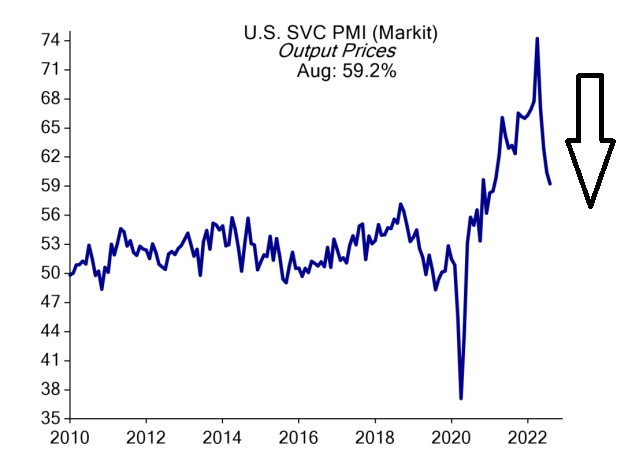

“Service” economy prices are now falling: Early 2021 was about manufacturing economy inflation and late 2021/early 2022 was about service economy inflation. Service PMI – a measure of the relative strength of the service economy – noting service output prices down sharply.

Conclusion: The Fed still needs to hike about 100bps over the coming months to really get inflation moving downward. Economic demand already weakening up. I strongly believe that we’ll get a very soft labor report sometime this fall and that will signal to all that the Fed needs to “pause”. As I have said before, when the Fed says “pause”, the market will hear “go”. Investor sentiment already in the bottom one percentile of historical readings. That datapoint cannot be ignored.

A change in monetary policy combined with already extraordinarily weak investor sentiment will be the launching pad for the next bull market in risk assets.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.