The economic data released over the last couple of months has painted a picture of an economy that is holding up fairly well, all things considered. Surveys of manufacturing and service activity halted their declines that started last year, and remain at levels consistent with economic expansion. Hundreds of thousands of new jobs are still being created each month, and a nascent and worrisome uptrend in unemployment claims has clearly rolled over. Consumer confidence is rebounding, while retail sales remain near all-time highs. As a result of the recent data coming in better than expected, the Citigroup Economic Surprise index has swung back into positive territory for the first time since May. Does this all mean the odds of a recession have fallen?

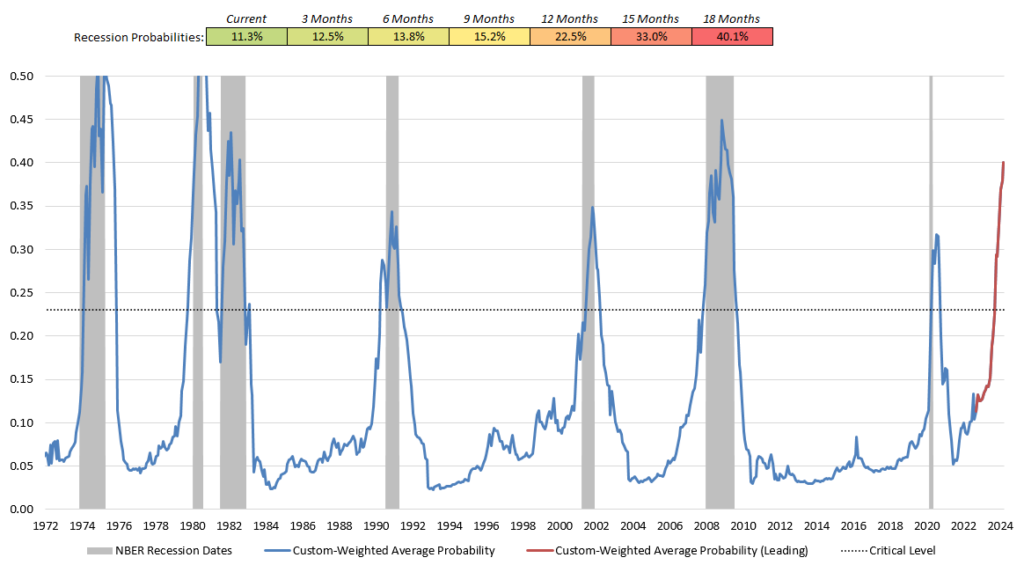

According to our recession model the answer is no, quite the contrary in fact. The model quantitatively and unemotionally calculates the odds of a recession occurring at any point between today and 18 months into the future, based on 20 factors that have historically demonstrated a strong statistical relationship in forecasting incoming recessions. While the model is currently (and correctly) concluding that the economy is not in recession at the moment by assigning it a low probability of 11.3%, the model’s estimate of future recession probabilities has steadily increased in recent months. Currently, the model estimates a 22.5% probability of finding ourselves in a recession 12 months from now, which rises to 40.1% 18 months from now. Probabilities of 22.5% and 40.1% may seem relatively low (after all, they are less than a 50% coin flip), but the unconditional probability of the economy being in recession at any point in time is roughly 14% (that is how often the economy has been in recession in post-war history). Therefore, a recession probability of 40.1% means recession is 2.9x more likely than normal. In the last 50 years of our recession model’s history, a recession always ensued once the model crossed above 23%, which we use as a critical threshold.

CWM’s Recession Probability Model Flashing Red

What is causing the model to get increasingly concerned about the outlook for the economy? When we look at the 20 factors that comprise the model and how they have evolved recently, we see a few key themes that are shaping the current recessionary message:

- Monetary policy keeps getting more restrictive

The yield curve is the most inverted since 2000 and the Fed hiked rates by 225 bps (about to be 300) in less than one year, which is the most aggressive pace since 1996. As a byproduct of this, mortgage rates have risen by 300 bps since last year, which is the fastest increase ever.

- Fiscal policy is also restrictive

After a period of unprecedented fiscal stimulus in response to the Covid-19 pandemic, the federal budget deficit is now rapidly closing and the fiscal thrust has turned into a fiscal drag. The two policy levers (monetary and fiscal) turning restrictive at the same time represent a double whammy for the economy.

- Energy eating into discretionary spending

Even with oil prices down roughly 30% since earlier this year and gas prices back below $4/gallon nationally, energy inflation is still outpacing overall inflation by the widest margin since 1981. This means that consumers are having to divert some of their discretionary spending towards their energy bills. This might be great if you are one of the oil majors, but not if you are the US economy and are made out of private consumption for 70%.

Overall, the message is clear: a recession likely lies shortly ahead. What does this mean for your portfolio? The stock market is a forward-looking discounting mechanism. Even though a recession most likely hasn’t begun yet, the S&P 500 index is currently down about 19% from its January 2nd peak, indicating that a lot of these economic headwinds have already been factored in. This of course doesn’t mean that we can’t go even lower. Just as stocks tend to peak before a recession begins, they also usually find a bottom before the recession ends, as they begin to discount the ensuing recovery ahead of time. However, until investors can get at least a glimpse of the faint shimmer of the light at the end of the tunnel, stocks could remain under pressure, with elevated volatility both to the upside and downside. Keep your seatbelts fastened!

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.