The market has done a reasonably good job this week shaking off some big, large cap tech earnings misses. Weak ad trends at GOOG and MSFT and then last night’s big META whiff. AAPL and AMZON report tonite. The ability to advance when the news isn’t great is actually a good sign and encouraging that we are closer to the end of this drawdown. Market technicals are healing, albeit slowly.

Are we in a recession yet? NO.

Will be in a recession in early 2023? YES.

The Fed’s charge-from-behind with regards to rate hikes has destroyed economic demand and greatly contracted credit conditions. With UST rates up, credit spreads up, and mortgage rates up the likelihood we march into recession in early 2023 grows by the day. It’s just a matter of time.

Three charts for your Thursday:

HOUSING DEMAND IS PLUMMETING

Mortgage applications fell -2% this week and housing buyer demand evaporates amidst a rising rate backdrop. Mortgage rates rose for the 10th week in a row and now sit at the highest level since 2001. A chart of 30y mortgage rates noted below. Tough to have a strong and safe economy when you have a housing market that is completely frozen. That’s where we are headed.

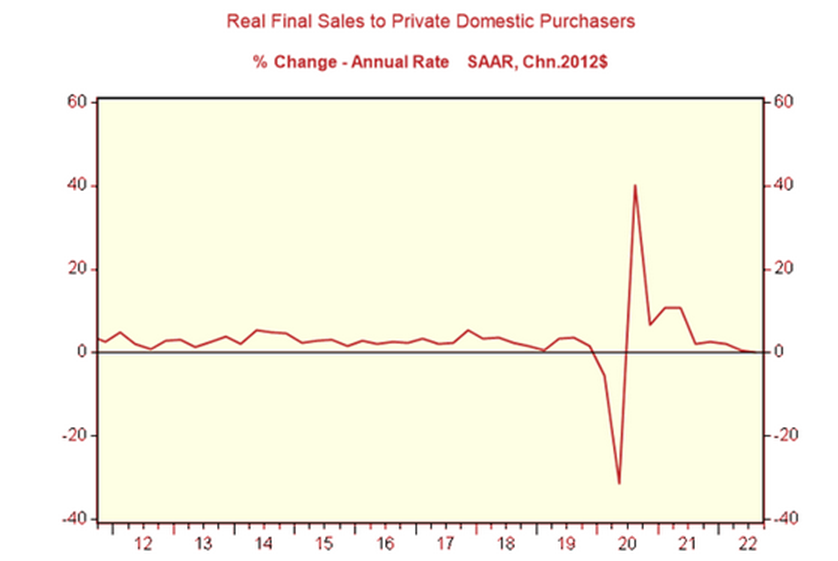

PRIVATE DOMESTIC DEMAND HAS ALSO BEEN HALTED

If you adjust this morning’s GDP report for inventories, trade and government in search of a true picture of private domestic demand, the picture is rather sobering. Just +.1% seasonally adjusted GDP growth. The economy has weakened and is getting weaker quickly.

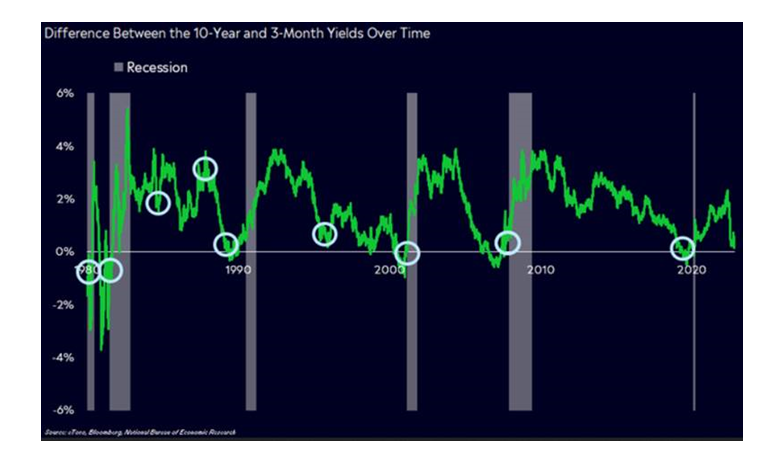

And lastly, THE YIELD CURVE HAS INVERTED. The market quotes 10y versus 2y UST yields for convenience when evaluating the shape of the yield curve and that has been inverted for a while now. But the Fed has quoted in the past 10y versus either 3mo bill or versus fed funds when they evaluate the shape of the yield curve. 10y UST v. 3mo bills is now inverted. Credit lending will dry up with the deposit rate and the lending rate now upside down. No lending = less economic activity = less job growth = higher recessionary likelihood…Tick, tick, tick.

This all sounds like BAD NEWS but strangely BAD NEWS with regards to the economy will be GOOD NEWS with regard to the pace of future rate hikes. The magic word remains “pause” because when the Fed starts hinting that is where they going, the market will hear “go” and likely rip higher off a base of historically poor investor sentiment and less restrictive monetary policy. Every crisis ends and we’re ten months into this one. #pause

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.