Today is Halloween, and so far it’s been a very spooky year for investors. Inflation, rate hikes, geopolitical conflict and recession fears have all been stirred up in a witches’ brew of volatility to drive equity and bond returns lower. But could the remainder of 2022 finally hold more “treat” than “trick” for stocks? Market seasonality suggests it just might.

Seasonality is simply the study of how the market performs throughout the year, on average. Most investors are familiar with the maxim of “sell in May & go away” which is reflective of market returns historically being lower in the summer and early fall, and stronger during the winter and spring months.

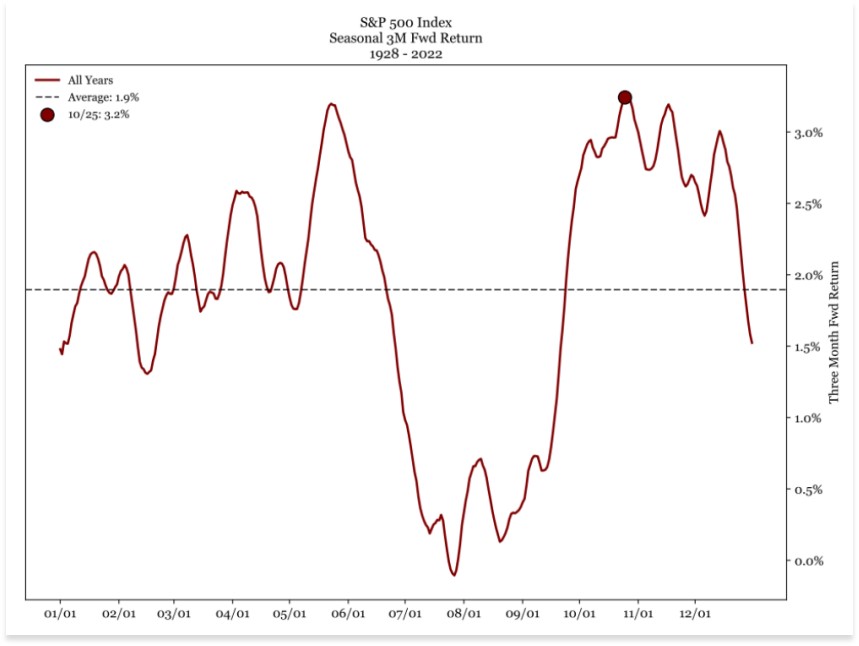

The chart below from Renaissance Macro is a variation of these seasonal studies. It shows the average forward 3-month return over the course of the year using the full history of the S&P 500 going back to 1928. In other words, every point along the line represents how the market performed over the following three months. Last week, we just happened to reach the high point for the year which shows that from October 25th, the S&P 500 has gained 3.2% on average over the next three months. This is well above the overall average return of 1.9% shown by the horizontal dashed line.

Of course, there are many other variables that will influence how the market performs over the remainder of the year. But in a year full of fright, seasonal tailwinds might help make things less scary.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.