The good news is that October 2022 just registered the best monthly returns for the DJIA since 1976. The DJIA returned +13.95% for October 2022, besting both the SP500 (+8% for the month) and the tech heavy Nasdaq (+3.9% for the month). Best month for the Dow since 1976, when a small computer start-up named “Apple Computer” was being founded by Steve Jobs, the film “Rocky” dominated the big screen, and Johnny Bench and the Cincinnati Reds Big Red Machine were finishing off the Yankees of New York to win their second consecutive World Series title.

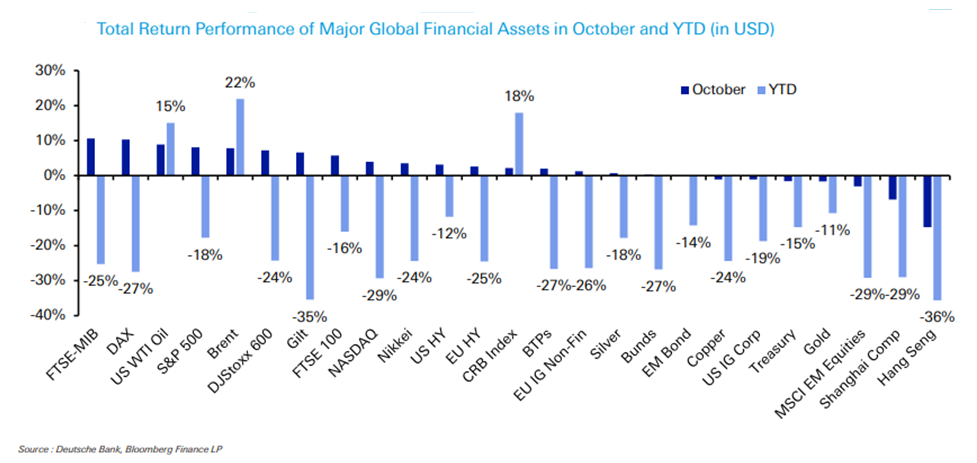

The bad news is that other than anything that rhymes with energy or oil, YTD results for most/all other asset classes are negative and not by a little. There’s been no place to hide. Fixed income/credit markets are having their worst year since 1785 (folks, that is NOT a typo). Tomorrow at 2pm ET is not to be missed. The Fed will hike 75bps, but the story to follow is the Fed’s post announcement press conference. They won’t “pause” yet, but “considering slowing the pace of future rate hikes” commentary will be met with glee by capital markets, both stocks and bonds alike. Please tune in.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.