Perhaps one way to try and digest yesterday’s Fed announcement and the subsequent Powell press conference is to quote President Harry Truman. When speaking about his own economic advisors, Truman said he only wanted one-armed advisors, because the economists he had on staff were always saying “on one hand…but on the other hand…”. Ol’ Harry would have pulled out his hair with the Fed’s performance yesterday.

I have a few takeaways from yesterday’s Fed announcement. First and foremost, the Fed clearly opened the door to a slowing pace of future rate hikes and did so in their written statement. The key language is in two new sentences in their statement:

- “The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

- “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

If inflation falls in the coming months, the Fed just gave themselves an out to start the process of slowing the pace of future rates hikes. That is 100% clear.

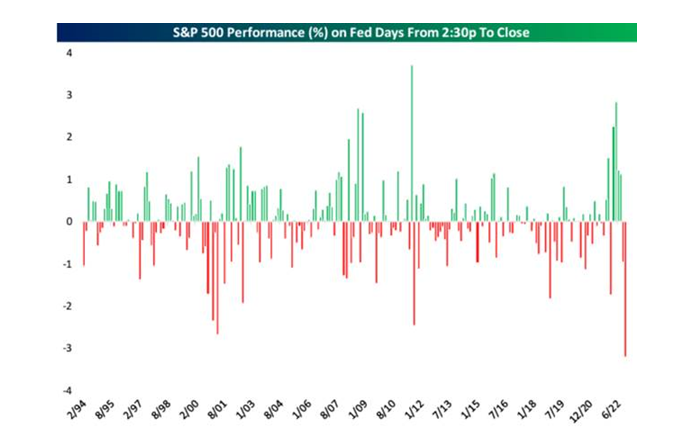

Takeaway Number 2 is that no one should be surprised by Fed chair Powell’s tough talk in his press conference. This was classic Powell, talking tough and being aggressive at the microphone. It has happened before and will happen again. His commentary was the other side to the inflationary coin: if inflation stays high, the Fed will need to continue to hike rates. It is a data dependent process, so everyone should follow the data. Markets hate one handed economists more than Truman and it sent the markets reeling. The final 90 minutes of trading yesterday were the worst 90 minutes on a day of a Fed press conference since they started doing press conferences on the day of a Fed rate decision announcement back in 1994.

So where does this leave us?

Between now and the December Fed meeting, the market will get two important CPI readings and two important labor market readings. The next 40 days will be rich with economic data. Everything is politics, including the alleged non-political role of being Fed chair. Powell just gave himself options to go in either direction and those moves will be determined by inflation readings over the course of the next month. The bad news for Powell is that we’re still likely – if not more likely now – to get an early 2023 recession and he’ll get 113% of the blame for that.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.