The death of the nation’s 16th largest bank was both swift and shocking and the events of the past few days as it relates to the bank run that went down at Silicon Valley Bank (SVB) has implications for both policy and markets. There are few knowns so far and plenty of unknowns. What is known is that SVB was in business last Wednesday and today is not. Unsecured creditors and equity holders at SVB have experienced permanent loss but the Fed stepped in over the weekend (as expected) and backstopped deposits of all shapes and sizes. Here are the three questions I have gotten the most the past few days:

What happened to SVB?

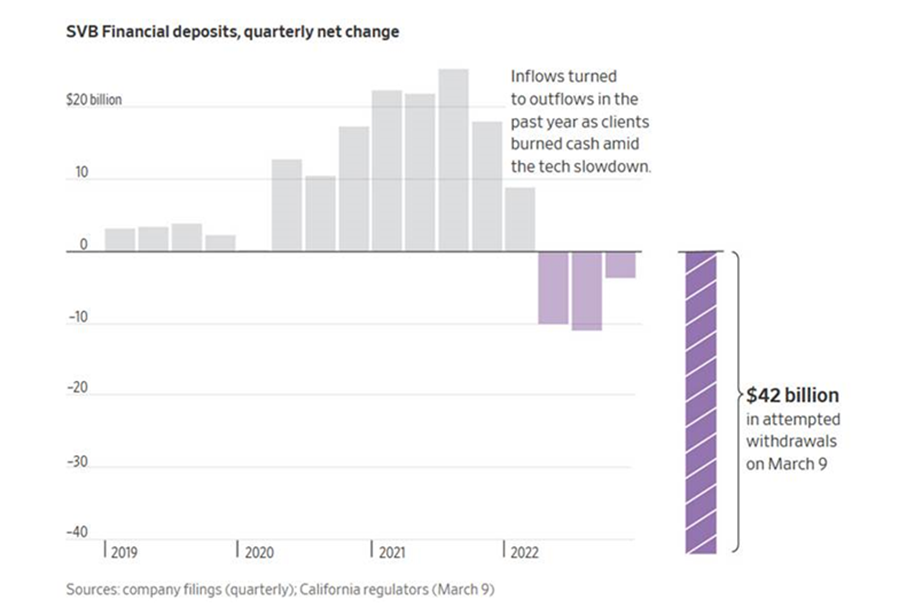

Classic textbook bank run in which approximately 30% of deposits were demanded back last Wednesday. SVB had about $200 billion in assets (mostly US treasuries and mortgages) and approximately $150 billion in deposits. SVB has an abnormally large exposure to the tech/venture capital world. Funding in that world has become more difficult in the past 6-9 months and deposits, once thought permanent, quickly became a lot less so. SVB has been leaking deposits for the past few quarters but the demand for +$40 billion in deposits last Wednesday led to forced selling of UST, which were already in an unrealized loss position. SVB management compounded the problem by a factor of a gazillion by hosting a terrible conference call for investors and announcing a $1.8 billion capital shortfall without a plan to address such. Announcing big problems without a plan isn’t a good idea. The entire tech world went to Twitter and all rushed to withdraw funds immediately. Demand deposits could not be met, and the FDIC took over on Friday. When the tech world cries about layoffs from this whole saga, please ignore such. The tech industry cut off their nose to spite their face. They caused the run on SVB and used social media as a weapon of mass destruction.

Source: Company filings (quarterly), California regulators, March 9, 2023

Is the Fed now guaranteeing all deposits, even those in excess of FDIC insurance limits?

Basically, yes. The Fed’s announcement over the weekend of three different lending programs to be made available to banks provides banks with sufficient capital to meet deposit demands. The Fed has infinite capital and these emergency measures should go a long way to calming runs on deposits. It will likely take a few days for things to quiet down but this action by the Fed is important to restoring order. They don’t want to see another SVB.

What the sector really needs is some M&A and new capital to really start to improve sentiment. Nothing says more than capital injections, even if an institution doesn’t need one. I expect very large money center banks similar to JPM, BAC, WFC and the like to step up and start to consolidate smaller, regional players. “Too Big to fail” is about to get even bigger. These money center banks will likely be able to buy assets and deposits on the cheap in the very near future.

Can the Fed hike rates with this all going on?

It’s difficult for me to see how the Fed can hike rates and suck liquidity out of the system at the exact moment the system needs more liquidity. A week ago, it was betting odds that the Fed would hike +50bps at its March 22 meeting. Last Thursday and Friday the 2y UST had its 4th largest two-day decline in yields EVER. The Treasury market is saying the Fed can’t possibly hike rates with this drama as a backdrop. I fully agree.

When events like this happen and the financial system takes a shock, it’s a natural and human desire to want to do something. The reality is that most times the best thing to do is nothing. Selling quality, well-built portfolios with the hope of buying those same assets back at lower prices never works. Not sometimes, never. Own quality assets, be disciplined, and be diversified. In the midst of crisis, opportunities always emerge. ALWAYS. We are looking for opportunities already and will add such to portfolios when price comes our way. Every crisis does end but this one just got started and will likely be here for a while. Please remain buckled up.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.