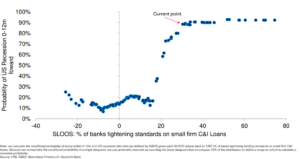

Our internal recession model has been flashing red for a while, and although lots of progress has been made vs. inflation the US economy has held up very, very while. Double checking our model here against a well-proven external source: the Senior Lending Officer Opinion Survey.

The Senior Lending Officer Opinion Survey (SLOOS) is a measure of bank lending standards and whether they are trending “accommodative” (easier to get a loan) and “tighter” (means…tighter). A tighter lending environment is symptomatic of a looming recession and the SLOOS data confirms such. The obvious take on the chart below is that once >30% of those lending officers surveyed start saying lending conditions are getting tougher, the probability of recession in the coming 12mos rockets to +90%. Data is data.

The SLOOS data is consistent with our view that (1) a US recession looms, (2) it’s time to own quality because non-quality will soon not have access to capital, and (3) stay away from areas of likely permanent loss like major metro area commercial real estate and anything that rhymes with “junk bonds” (that’s where the defaults happen). And despite what Fed officials might be saying in front of microphones this week, it is consistent with the belief that this Fed rate hiking cycle is done and ever-increasing odds that the next Fed move is a cut, not a hike (maybe by mid-2024).

Source: FRB, NBER, Bloomberg Finance LP, Deutsche Bank as of November 7, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.