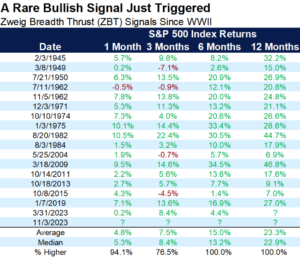

It has been a great two weeks for the S&P 500. The market closed higher in each of the last 8 sessions, which lifted the index back above key support at 4150/4200, and back above the 50 day and 200 day moving averages. This move higher produced some short term ‘thrusty’ action, which means breadth (individual stock participation) went from really, really bad to really, really good over a few days. Specifically, we just got another Zweig thrust bullish signal, and as you can see in the chart below, this is a great sign for forward stock returns. Every time we have gotten this signal, stocks were higher over 6 and 12 months with average gains of 15% and 23% respectively. I like those odds.

Source: Ned Davis Research, Factset as of 11/3/2023

I also like the leadership I see from technology stocks. The technology sector, XLK ETF in the chart below, has been a leader for a very long time. Zooming in on the last two years it was a leader to the downside during the 2022 bear market and to upside in the new bull market that started in October 2022. So, when I see the sector break above its consolidation pattern (it’s been in a down channel since July marked by green lines) on the top chart while simultaneously moving to a new all-time high against the S&P 500 on the bottom chart, I have more confidence that a bottom in stocks is in place.

Source: Stockcharts.com as of 11/8/2023

Next, I want to see long term breadth improve. Based upon the two things just mentioned, it should happen, but I’ll be watching closely. This is a measure of stocks above the 200-day moving average. As of yesterday, the reading is 39%. That is worrisome as that means a lot of stocks are under their own 200-day average, and historically, that is bear market territory. The red boxes I placed on the charts below show the bear markets of 15/16, 2018, 2020, and 2022, and they all had consistent breadth measures below 50%. Will this be a narrow short term bull market at the end of the year, or will breadth expand on a longer-term basis and a much longer bull market be in store?

Source: Stockcharts.com as of 11/8/2023

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.