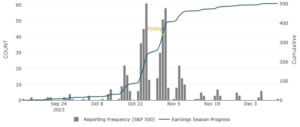

We are entering the final stretch of Q3 earnings reporting season. As of yesterday, 310 companies representing roughly 66% of the market capitalization of the S&P 500 index have already reported results. Another 121 companies are scheduled to report before the end of next week, at which point the season will slowly die down, with the remaining stragglers spread out over the following few weeks.

Results so far have been much better than expected. Before companies began reporting, Q3 earnings were expected to fall by 0.3% compared to the same quarter a year ago, which would have marked the fourth consecutive quarter of year-on-year earnings declines. However, earnings reported so far have been 7.8% higher than expected, which has put them on track to come in 2.7% higher than the same quarter a year ago. This would mark the first quarter of year-on-year earnings growth since Q3 2022. The strong showing we have seen so far is the result of both better-than-expected revenue growth (+2.1% versus 1.6% expected) and a widening in profit margins (12% versus 11.9% a year ago). In turn, these can be attributed to a stronger than expected economy during the quarter, and to a continued easing of inflationary pressures.

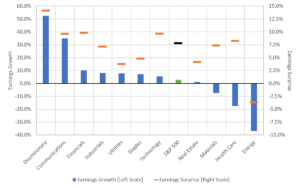

From a sector perspective, consumer discretionary has been the sector posting the strongest earnings growth (+52.5%) and the biggest positive surprise (+14.2%), largely thanks to its heavyweight Amazon, which benefited from strong consumer spending during the quarter. At the other end of the spectrum we find the energy sector, which has been reporting the weakest earnings growth (-36.9%) and also negative surprises (-3.6%). Lower oil prices compared to a year ago are the main culprit behind the energy sector’s earnings decline. It is worth noting that if the energy sector were excluded, the aggregate earnings growth rate for the S&P 500 index would improve to 8.4% from 2.7%.

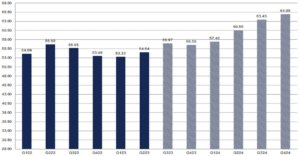

Despite the overall positive results described above, the market response has been underwhelming. Companies that reported positive earnings surprises for Q3 have seen an average stock price decrease of -1.0% around the report date, compared to a five-year average price increase of +0.9%. That is because the narrative has been dominated by the surprisingly negative guidance that companies have been issuing regarding future profits. Out of the 42 companies in the S&P 500 index that have issued guidance for Q4 2023, 67% have issued negative guidance, which is above the five-year average of 59%. Analysts have been reacting to this by downgrading their earnings estimates for Q4 2023, as well as for CY 2024. So far, this has not been enough to put a serious dent in the earnings recovery that the consensus still expects for next year, with 2024 earnings still projected to be 11.8% higher than 2023 earnings. However, that could change if this trend of negative guidance persists, and if the economy downshifts from its current strong growth trajectory, as we expect it will. At the same time, a further easing of inflationary pressures should continue to aid the margin recovery, which could put a floor under earnings growth, keeping it rangebound.

Q3 2023 Earnings Growth and Surprises by Sector

Source: Bloomberg, as of 11/1/2023

Consensus Points to Earnings Recovery Ahead

Source: FactSet, as of 11/1/2023

Q3 Earnings Season Progress

Source: Piper Sandler, as of 11/1/2023

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.