It seems like forever since we started talking about recession. The yield spread between 10-year and 2-year treasuries (a.k.a. the yield curve), one of the earliest indicators of recession, first inverted 14 months ago. In today’s world of fast-paced financials markets and news cycles, 14 months is forever. So, it may be tempting to think that if we were going to have a recession, it should have happened already. Yet the economy remains remarkably resilient. After growing at an annualized pace of 1.3% in Q1, GDP is currently projected to grow by 2.0% in Q2 according to the Atlanta Fed’s GDPNow model. So, no recession then? Perhaps we managed to avoid one. Mentions of the “R” word in the media peaked in the middle of last year and have declined substantially, suggesting that recession concerns have abated somewhat.

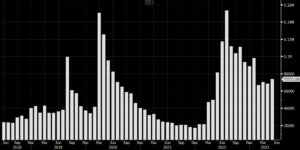

Number of News Articles Containing the Word “Recession”

Source: Bloomberg, as of 6/2/2023

Unfortunately, the data suggests such optimism may be misplaced. In the absence of other recessionary forces such as an exogenous shock, it can take a long time for monetary tightening alone to filter through the economy and slow it down. The typical lead time between an inversion of the 10-year to 2-year yield spread and the ensuing recession is around 18 months. This means that, based on this factor alone, it is actually too soon to expect a recession. This particular version of the yield curve reached its most inverted level (so far at least) in March of this year, which implies that recession risk will be highest by September of next year. Other monetary-related indicators (such as different versions of the yield curve, the rate of change in the Fed funds rate and in mortgage rates) have slightly different lead times, but they all point to recession risk being most elevated around mid-2024.

Meanwhile, a few of the non-monetary-related indicators included in our recession probability model are also starting to give some warning signs. Chief examples are the ongoing decline in the Leading Economic Index (published by the Conference Board) and the recent tightening of bank lending standards. This is concerning because these types of factors tend to have much shorter lead times to recession, sometimes as short as one month. Not all of them are in agreement, however. Notwithstanding a slight softening of the job market recently, we are not even close to the degree of job destruction we expect to see when a recession is at hand. Credit spreads and delinquency rates remain very low, while new home sales and auto sales have even picked up recently. This suggests that in the near term, the economy still has some runway ahead.

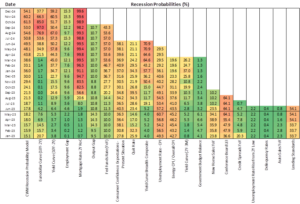

The table below is a bit busy, but it shows the month-by-month recession probabilities implied by the individual factors comprising the model. The probabilities are color-coded: green is good, red is bad. Currently, we see a lot of orange and red beginning to cluster around the first half of next year.

Source: Congress Wealth Management, Bloomberg, as of 6/2/2023

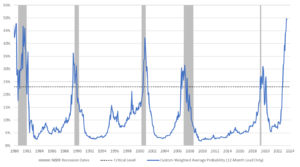

Putting it all together, the chart below plots the 12-month-ahead recession probability estimated by our model going back to 1980. The current estimate is the highest since 1980. Recession fatigue may be setting in, but this is no time to let the guard down.

Source: Congress Wealth Management, Bloomberg, as of 6/2/202

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.