As expected, our beloved elected officials waited until the very last moment and then cut a deal that does little for the budget but does avert a financial calamity. I can’t tell you all how happy I am not to be discussing the debt ceiling issue until late 2024. It really is just dinner theater that helps sell ads on CNBC.

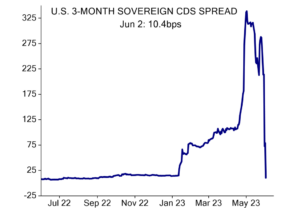

CDS stands for “credit default swap” – it’s basically how Wall Street quotes the default probability on bonds. The lower the number, the lower the probability of default…and vice versa. The chart below captures near term CDS contract rates on our national debt. It’s been rising for the months leading up to this week, and now has utterly collapsed back to normal as the debt ceiling deal was cut. This picture says the crisis is over…onward.

The bigger thing to focus on now is (1) investor sentiment is extremely weak (too much cash on sidelines), (2) institutional investor positioning is very weak (record short SP500 futures contracts), the Fed is taking June rate hike off (maybe they do 25bps hike in July but I doubt it), and this morning’s labor report was truly a “goldilocks” report (not too hot, not too cold…just right). Those short the market now need to chase the market – what’s happening today is called the “pain trade”. For those record shorts, the most painful thing now is chasing a market that is breaking out. Sean has been pounding the table on the need for SP500 to clear the all-important technical level of 4200, and today’s price action is helping the market clear that hurdle.

Sometimes markets trip, sometimes markets flip, and sometimes markets rip. The VIX volatility contract just crashed to an 18mo low. If it looks like a rip, and trades like a rip…it’s a rip. As we often say, you just can’t sit out and miss +600 pt days on the DJIA. You have to be there to catch them when they happen.

Source: EISI as of June 2, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.