As markets brace for the Fed’s rate decision tomorrow 2pm EST (+75bps overwhelming consensus…it’s already priced in and known), economic demand continues to be destroyed and inflation expectations are falling. Gold down -18% over past 8 months, lumber prices down -65% over past 8 months, shipping freight rates down -52% over past 8 months. Tighter financial conditions – most notably higher risk-free yields and a strong USD – are destroying economic demand across the board. Inflation is coming down and it’s coming down quickly.

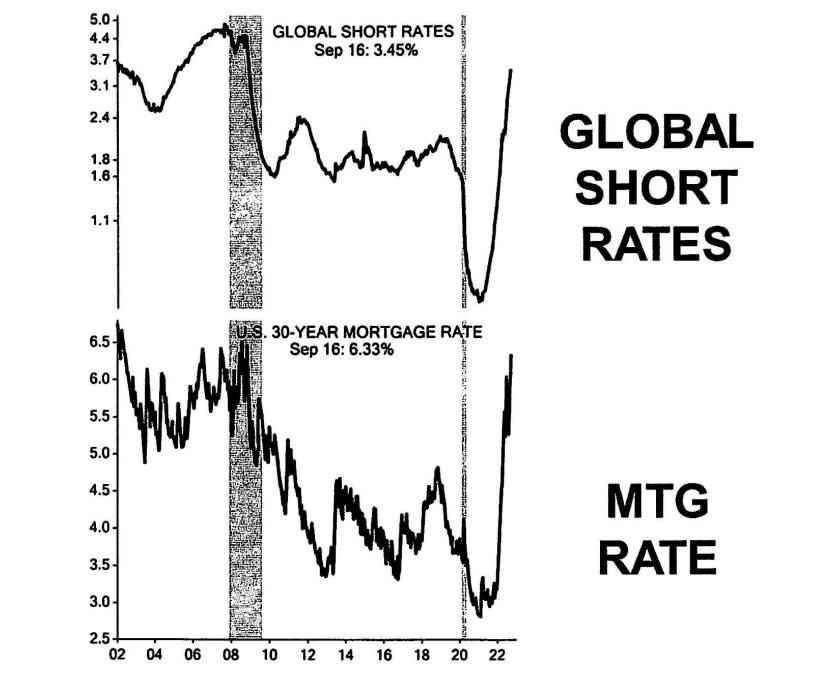

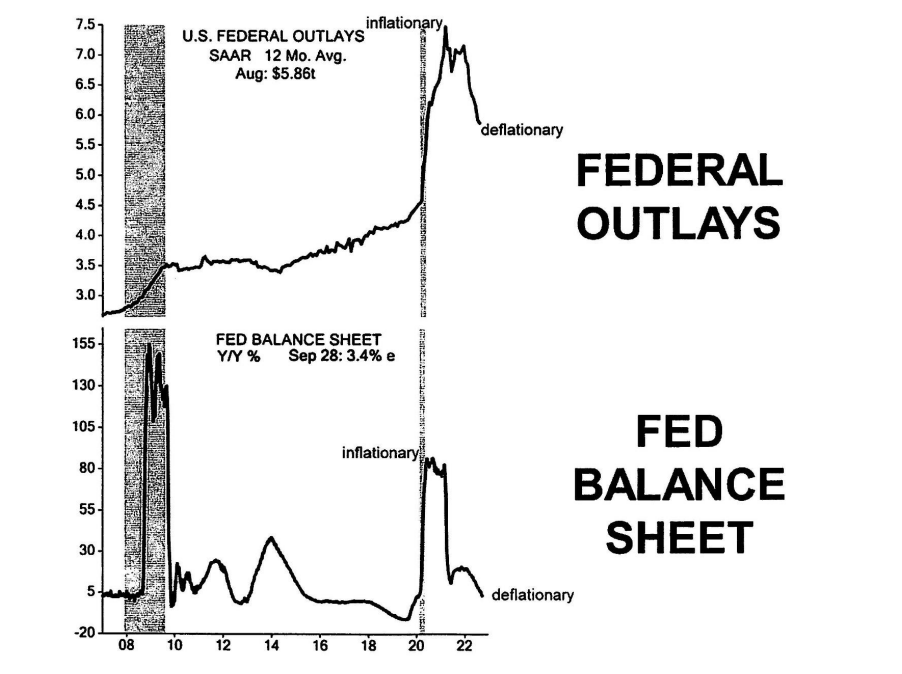

If the period March 2020 to December 2021 was the Golden Age of Quantitative Easing (absurdly loose monetary policy), 2022 has quickly turned into the Dark Age of Quantitative Tightening, and it’s not just about the Fed hiking rates. The QT we are seeing now is a synchronized, coordinated plan to destroy economic demand. It’s the Fed hiking rates, it’s a sharp decline in Federal outlays, and it’s the Fed shirking its own bloated balance sheet. The charts below tell the full story. Liquidity is being sucked out the system at an historic pace. The economy is slowing, and inflation is coming down. Like it or not, despite being very, very, very late to act the Fed and these combined activities are bringing inflation down.

Consumer sentiment is already at multi-decade lows. Rent gains are slowing dramatically. Labor will be the last to fall but it likely falls this fall. The shock of a negative monthly job report will likely force the Fed to utter the most magical phrase of all: “we’re taking this opportunity to pause”. “Pause” will mean “go”, both for the economy and price and trajectory of risk assets.

Remain buckled up – and stay long.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.