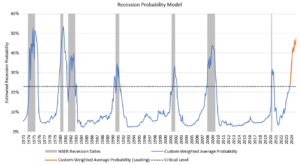

As we enter Q4, the economy continues to have significant momentum behind it. A consensus of economist estimates the economy should have grown by 3% in Q3. Meanwhile, the Atlanta Fed GDPNow model’s current reading of 4.9% suggests there may be upside risk to that forecast. However, even against such a strong backdrop, recessionary pressures appear to be intensifying. According to our proprietary recession probability model, the odds of an economic contraction have steadily increased in recent months and are projected to continue to increase over the next several quarters. More specifically, the estimated probability of the economy being currently in recession (blue line below) has now officially crossed above the model’s critical level, above which a recession becomes the most likely scenario. Over the last 50 years of the model’s history, once the probability crossed above the critical level, a recession always ensued in short order. From here, recession probabilities are projected to increase further (orange line below) over the new several quarters, reaching the highest level since 1981 by next summer.

Source: Congress Wealth Management, Bloomberg, as of 10/4/2023

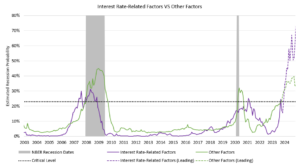

Since the yield curve first inverted early last year, it has garnered a lot of attention for its historical ability to predict recessions. The yield curve has indeed inverted prior to every recession of the last 50 years. However, the lead time between inversion and recession has varied greatly, ranging from 7 to 21 months. This means that the yield curve’s usefulness as a tool for timing the onset of a recession with any degree of accuracy is fairly limited. While the yield curve and other yield-related indicators are important factors behind the model’s recessionary signal, they only make up about 30% of our model. The remaining 70% of the model is based on factors that are not directly related to interest rates; these factors include indicators related to trends in employment, housing, inflation, consumption, investment, and fiscal policy. Compared to the yield curve, these factors tend to have shorter yet more reliable lead times in predicting recessions.

The chart below dissects the model’s estimated recession probability into interest rate-related factors (purple line) and other factors (green line). Clearly, both sides of the model have contributed to pushing the estimated recession probability above the critical level, and both are expected to continue to push it higher going forward. The fact that the model’s recessionary message is no longer just based on yield curve-related factors but is now being confirmed by other factors representing different parts of the economy, increases our confidence that a recession is indeed approaching. This does not mean that a soft landing can be completely ruled out, but it does mean that the path to a soft landing is narrowing quickly.

Source: Congress Wealth Management, Bloomberg, as of 10/4/2023

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.