Impossible to ignore the material move higher in 10y UST yields. 4.73% on the 10y UST is its highest level since late 2007. Three take-ways from me on this:

- The Fed doesn’t have to hike rates – the market is doing it for them for free. Higher yields and a stronger USD$ are key ingredients for tighter financial conditions and that’s where we are today. When financial conditions get this tight, something’s gotta give.

- My bet on what “might give” is growing as yields rise and the USD goes higher. #1 US office space real estate, #2 US and global high yield debt, and #3 emerging market equities (hyper allergic to a higher USD$ now top my list. #1 is a consensus call and won’t come as a shock to many/any. #2 is just a direct victim of higher yields and declining credit liquidity. When you get a recession that’s where all the defaults happen. We will continue to stay away from HY credit. #3 is a new one but emerging markets are suffering from weak fundamentals and now a very strong USD$. Don’t be surprised if an EM currency cracks first. The good news is that EM valuations are already very, very, very cheap – that’s a good place to add to risk when it starts raining volatility.

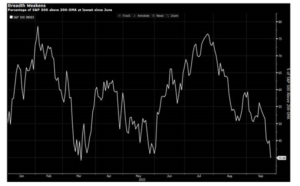

- Sentiment has weakened and markets technical now look soft. It’s been a rough couple of weeks for technicals. The chart below says it all: the percentage of stocks in the S&P500 trading above their 200 day moving average is at its lowest point in 15 months. Markets are ripe for pullbacks when technical are soft and sentiment is weak. Not the end of the world – but reset near term expectations. Markets don’t often spend much time with so few stocks trading below big important technical levels, but when they do volatility comes. Market technicals must be respected.

The best thing for the market right now is a weak ISM prices paid number on Wednesday and a soft jobs report on Friday. I can’t believe I just typed that but it’s true. “Soft” or “weak” now means “good”.

Source: Bloomberg and JonesTrading LLC as of October 2, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.