In the past three months, the yield on long-dated UST has increased by about +100bps. The front end of the yield curve has barely budged but yields on 10y-30y UST debt are up and up sharply. The Fed controls the front end of the yield curve, but the market controls the back end of the yield curve. So why is this happening now?

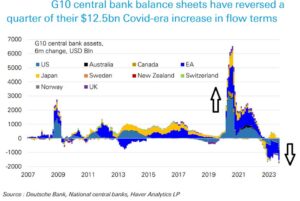

Growing list of reasons why this is happening: (1) US economy still very solid and with a strong labor market, future GDP growth looks also to be higher. Higher growth, higher yields. (2) Supply of US Treasuries on the increase as the government spends and spends. Simple supply > demand. And (3) the never-before-seen increase in global central banks’ balance sheets driven by all the COVID stimulus trying to be worked off. Every global central bank executed “quantitative easing” (money printing, bond buying, drive interest rates to zero phenomenon) to the tune of about $12 trillion (yes, with a “T”). Now global central banks are trying to reduce their holdings of both mortgage back debt and risk-free assets (UST) through balance sheet run-off or outright sales. This is called “quantitative tightening”, and it amounts to balance sheet shrinkage by all the major global central banks. Risk-free assets have been shed/sold/shrunk to the tune of $3 trillion so far but everything links back to supply and demand basics. To put it simply, the Fed is now a seller of long-dated Treasuries, not a buyer and that’s a headwind for long rates until they stop.

Long rates will stop rising when we get a recession. The Fed will likely cut rates then but also stop shrinking their own balance sheet at the same time. Quantitative easing giveth and quantitative easing taketh away. Tides do go out too.

Source: Deutsche Bank, National central banks, Haver Analytics LP as of October 10, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.