Pardon the reference to the great Earth, Wind and Fire lyrics but yesterday’s performance by Fed chair Powell was uber hawkish, lots of tough talk about rates and inflation and the path forward. Not really a lot good to take out of it so I won’t try. I wish he was half as tough last January/February 2022 when the Fed lost market confidence and got behind against inflation by 3 touchdowns on the road. A better narrative yesterday might have been to focus on progress to date with regards to inflation (it’s coming down across the board), demand destruction (it’s happening with regards to housing and rents and commodities and consumer spending), and the impact of tighter financial conditions (yields higher, USD higher, credit spreads wider – all helping eliminate bad speculative behavior of the summer of 2021). But that wasn’t how yesterday’s show went down. I am convinced that a very weak labor report looms in front of us and the Fed will be to blame when its comes to a recession in early 2023. The Fed has gone from doing nothing to doing too much. I think the Fed will be forced to cut interest rates by mid 2023. The Fed under Powell never misses an opportunity to miss an opportunity. I’ll give him a D- on his report card.

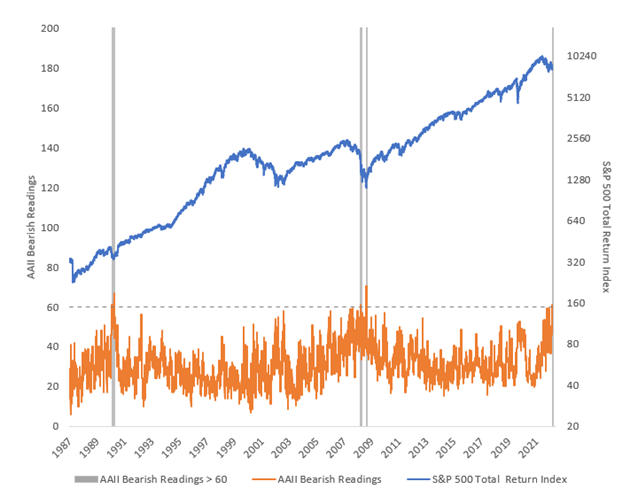

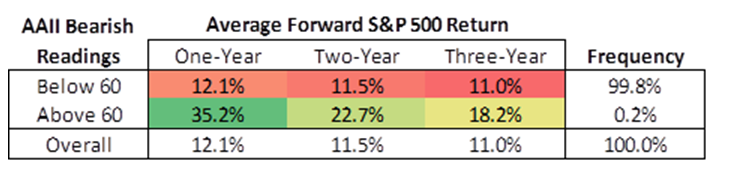

The popularity about being negative with regards to the market is all consuming. Investor sentiment has been extinguished/obliterated/annihilated. This cannot be downplayed. A look at the AAII Bull/Bear survey dating back to 1987 says current extreme bearish readings have only occurred .2% over the past 35 years. Bearish readings now exceed 60 – which NEVER happens. The last time we got such a bearish reading was early March 2009 (within days of the bottom of the Great Financial Crisis). While the last 13 years have been a great bull market run, don’t forget that tough times did exist during this period, including the August 2011 US treasury debt downgrade, summer 2016 Brexit, and, of course, March 2020 and COVID. The current bearishness reading greatly exceeds all of these other rather rough observations. It’s gotten very cool to be very negative on owning risk assets.

But data is data and we looked at all the other times bearish readings exceeded >60 and what FORWARD returns from such moments of bearishness. Such readings only have occurred .2% of the time, but a look at what FORWARD returns look like 1year out, 2years out, 3years out from such bearish moments speak volumes about extreme sentiment and forward returns. .2% of the time it works all the time.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.