Whenever Fed chair Powell goes in front of a microphone or a podium, I get slightly nauseous. Powell never misses an opportunity to miss an opportunity. Powell’s pledge yesterday to fight inflation is a valiant oath but one that is coming too late. Inflation is already going down and going down fast. Powell also dismissed recession fears. I think he’s the only one in the financial markets not thinking a recession sits at our immediate door step. Pretty tough talk from the guy whose Fed totally missed the ramp in inflation in late 2021 and started hiking rates/shrinking their balance sheet at least six months late. Markets don’t like anything he had to say – the price action in risk assets this morning confirms such.

Three takeaways from yesterday’s FOMC meeting and commentary:

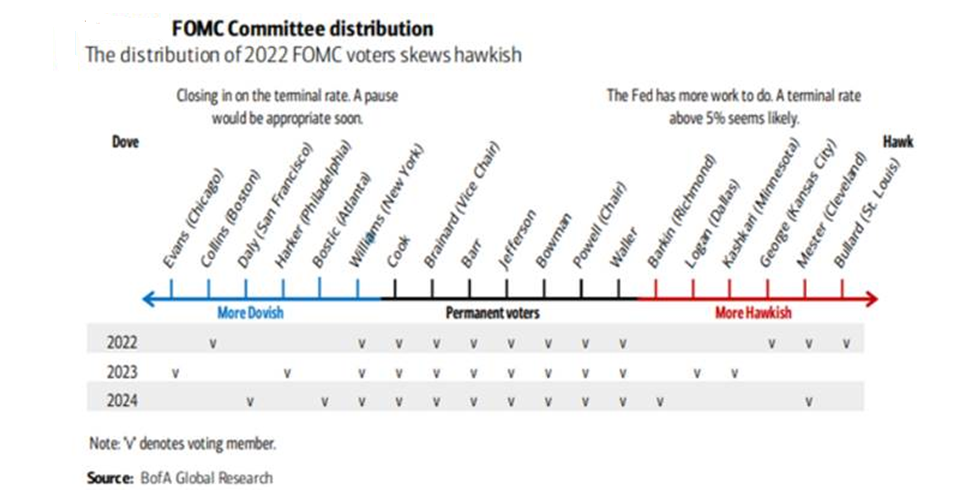

1. Voting members on the committee switch over in the new year – rate hawks took one last swing at policy before the balance of the voting members become more dovish in 2023.

2. The San Francisco Fed issued their estimate of the “proxy” fed funds rate. Their estimate includes the fed funds rate PLUS all the additional tightening brought on by quantitative tightening (QT) i.e. balance sheet shrinking. The SF Fed estimate on the proxy fed funds rate is 6.5% today!!! Extraordinarily high and certainly more than plenty to push the economy into a 2023 recession. The Fed started six months late in fighting inflation and now is jamming the brakes on the economy.

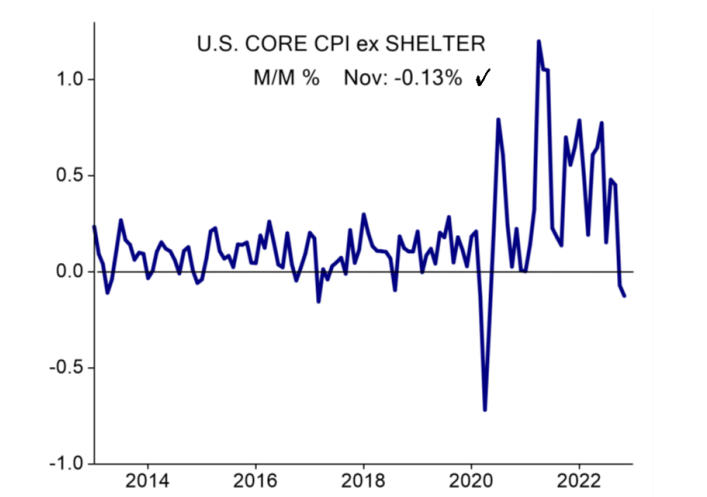

3. And…INFLATION IS CRATERING ALREADY. Core CPI inflation (excluding shelter) is basically zero today. The Fed has pledged to fight inflation to the death. My point is that it is already dying. Despite Powell’s claims yesterday, I strongly believe that this battle will end in recession. Too much hiking too late.

The conclusion is that Powell didn’t get it a year ago when inflation really started to hum and he and the Fed ignored the markets signal to stop record accommodation. Today he wants to fight a battle against inflation that is already well into the late innings. Is inflation elevated? Most certainly yes. Is inflation going down and going down quickly? Most certainly yes #2. The direction and the pace of change matters to markets. Markets are saying we get a recession.

It’s Powell vs. the markets…..my money is on the markets. Remain buckled up. Volatility will spill into 2023.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.