Here’s the report card on capital market asset classes for 2022:

What worked: very, very little. Oil (either flavor, brent or WTI), energy equities, MLPs, and silver was up modestly. Gold (allegedly the inflation hedge) was flat in the fastest inflation environment in 50 years.

Most major equity markets (including the SP500) were down in the range of 15-22%. Russia was down -36% before it basically closed/was shuttered.

Bitcoin, crypto, and the final days of FTX all indicative of the end of the zero-interest rate era. Speculation, in all forms, has been extinguished/eliminated/crushed.

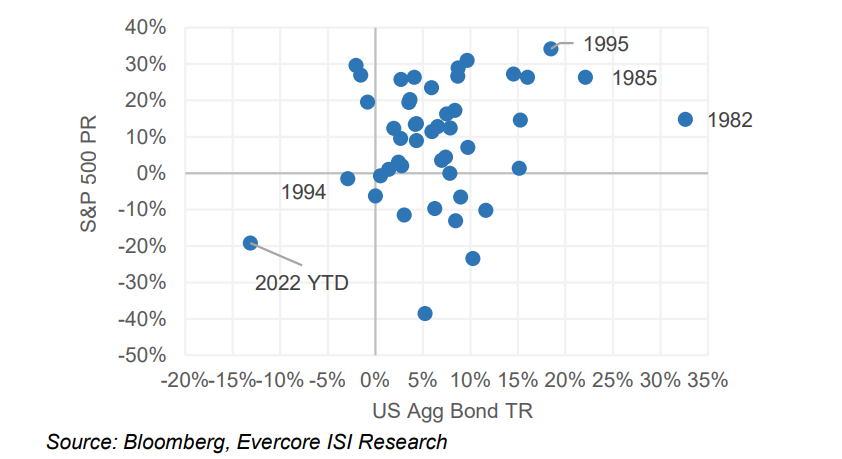

In my mind, the story of the year isn’t stock volatility, it’s bond volatility. The US Treasury market just put in its worst performance year since 1789 (that is not a typo). US Treasuries down -15%, Barclays aggregate bond index down -15%, Italian BTPs down -22%, German bunds down -33%, UK Gilts down -33%. In the past 40 years, there has never been another year in which BOTH stocks and bonds got hammered. That lower left-hand corner in the chart below speaks for itself. It’s the lonely, sad quadrant.

Amid volatility, opportunity presents itself. We’ll be out with our list of opportunities and themes this week.

Source: Bloomberg and EISI as of January 1, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.