The broad market backdrop continues to play out as we await the Fed’s 50bps rate hike on Wednesday. Inflation is elevated but coming down very quickly. The US economy is highly likely to be in recession in 1H23 because financial conditions got very, very tight. Investor sentiment remains very weak as measured by put/call ratio, bull/bear ratio, and elevated cash levels being noted in fund manager surveys. If the Fed goes into “pause” mode in early 2023 it’ll be right AFTER a weak labor report. All of that sounds sort of negative but when you get hit by a pandemic the playbook appears to want to follow the “bad means good” strategy. The market wants to see bad data because it’ll trigger a Fed shift in rate policy.

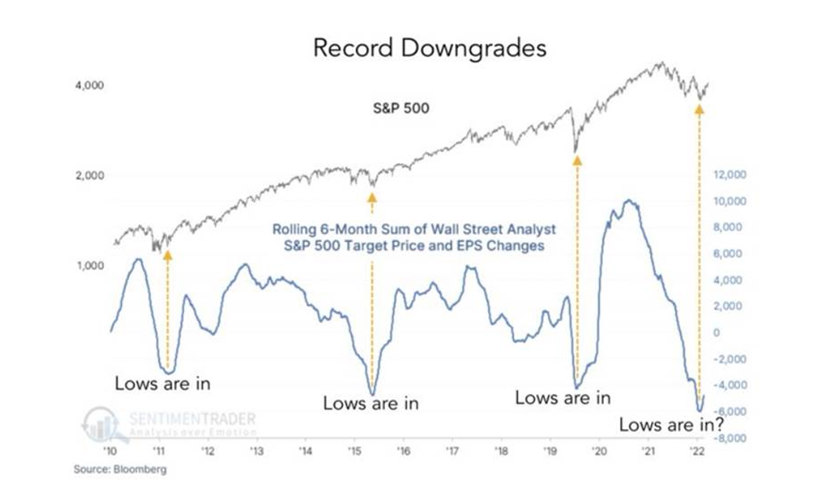

Institutional investors have now joined in, going negative after a long period of volatility and are playing their role right on cue as well. Institutional investors are human beings too and after this extended period of volatility, consensus has now turned into a cycle of individual stock downgrades and price target reductions on individual equity names. The chart below captures big cycles of downgrades and price target reductions. Over the course for the past 12 years, there have been four similar cycles of institutional investors downgrades: late 2011 (AFTER the market sold off in August/Sept/Oct 2011 and AFTER the US Treasury debt got downgraded), early 2016 (AFTER the market had sold off in late 2015/early 2016 and AFTER energy prices cratered), spring 2020 (AFTER we got hit by a global pandemic and AFTER the market went down by -30%), and now. How much of the negativity is already in the price of the market? In my mind A LOT. Record downgrades appear to accompany market bottoms, not tops.

This morning’s soft CPI inflation data is welcomed, but if you really want to see some holiday cheer from the market that may have to wait to a weak labor market report. That is a comin’ – jobs cuts and layoffs abound – but maybe not til the new year. Bad means good, “pause” means go. Fed chair Powell may not get to play Santa Pause until early 2023 as it comes to rates and policy.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.