Over the past 8 months, financial conditions have tightened a lot. Interest rates higher, mortgage rates higher, and a stronger USD are all symptomatic of tighter financial conditions. The Fed sees this and wants this to happen. In their minds, the central banker playbook calls for tighter financial conditions in order to fight current inflationary pressures. Tighter financial conditions destroy economic demand at the margin, thus relieving inflationary pressures. That process is well underway. Initial jobless claims on the rise, layoff announcements on the rise, commodity prices lower, gasoline at the pump lower.

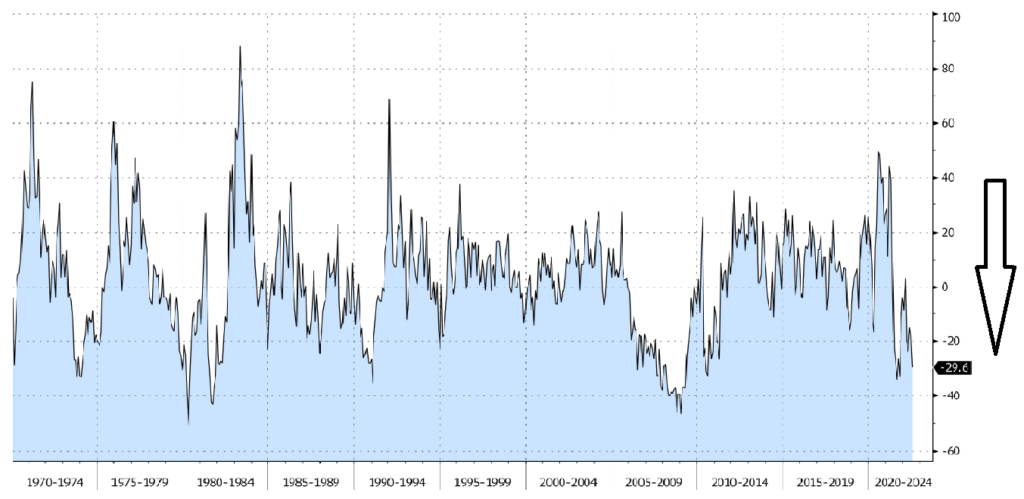

Residential housing is an important part of this process too and demand for US housing is down and down a lot. The top chart looks at the percentage change in new home sales. A -30% drop over the last 12 months – not as bad as 2009/2010 but close. The second chart looks at actual units of new homes sold. Between 2020 and 2021, there were about 825k new home sold annually. That number has fallen to just 500k annually now – roughly down about -35% from the 2020/2021 period. You must go back to 1980 to see a weakening trend as bad as the past six months for housing and new home sales.

Lumber prices are down -60%, gas at the pump is down -22%, and now the housing market is softening. I think the Fed raise another +100bps between Sept/Oct and by that point both the market and the Fed will be at roughly the same level for short terms rates. All it will take is one weak employment number this fall to send the Fed into “pause” mode with regards to additional rate hikes. Markets don’t like the word “pause” – they LOVE it. When the Fed says “pause”, the market will hear “go”. I think the next thing to weaken is the labor market and that might happen right about the time the New England Patriots are limping into their early November bye week (probably with a 3-7 record, but I digress).

US New One Family Houses Sold Annual Total YoY (%)

US New One Family Houses Sold Annual Total (Thousand Units)

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.