It’s a fabulous Tuesday morning. Schools in Maryland have opened, and the weather is starting to moderate. Now, we need inflation to follow!

On that front, good news continues to come and we still believe peak inflation to be behind us. For essentially this entire year we have described an economy that is moving from goods to services, which is a much-needed hand off for a service-based economy. Due to supply chain disruptions and production capacity, the amount of goods demanded by our economy started the inflationary spike. From houses to wood, cars, and semiconductors the economy was unable to handle the massive mismatch between supply and demand. But as our demand switches to services that disconnect normalizes and inflation rates should follow.

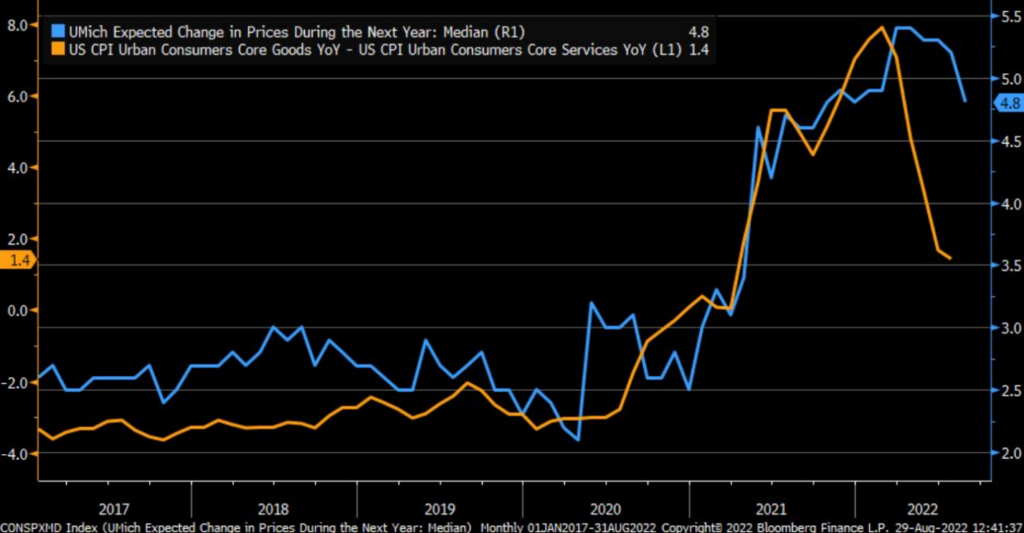

The orange line in the chart below is the difference between goods inflation and service inflation year over year. This measure reached a peak of almost 8%! in the first quarter 2022. That level is now only 1.4%. On a forward-looking basis this is a great indicator for lower price levels in the future as it has a decent relationship with UMichigan Expected Changes in Prices (see blue line in chart below) during the next year. Inflation expectations are rolling over and should continue to do so as goods inflation continues to weaken relative to service inflation.

For Fed watchers this should be of particular interest. The Fed literally stated that the UMichigan survey was the reason they hiked rates 75bps instead of 50 bps during their June meeting. The Fed will continue to hike rates as Powell clearly stated during the Jackson Hole speech last week. However, as the economy continues to slow, and inflation continues to roll over, it is now a matter of when and where they pause the rate hikes.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.