The Fed convenes later this week at Jackson Hole for their annual meeting/retreat/gathering/etc. Agenda looks like Wednesday night dinner, Thursday all day academic session on economic white papers, and Fed chair Powell speaks Friday morning. If you’ve got a PhD in monetary theory or just love a good 300-page summary on the role of the Fed in a global economy, this is your Super Bowl.

Powell will most likely talk tough about inflation and the Fed’s commitment to higher rates. No one should expect him to stray from the “inflation is bad and we’ve got to get it lower” rhetoric of the last six months. Market rates are still currently 100bps higher than the Fed’s official rate. I expect the Fed to execute +100bps cumulative in rate hikes in Sept and Oct to close that gap. Markets like certainty and closed gaps. The next two moves will accomplish a lot.

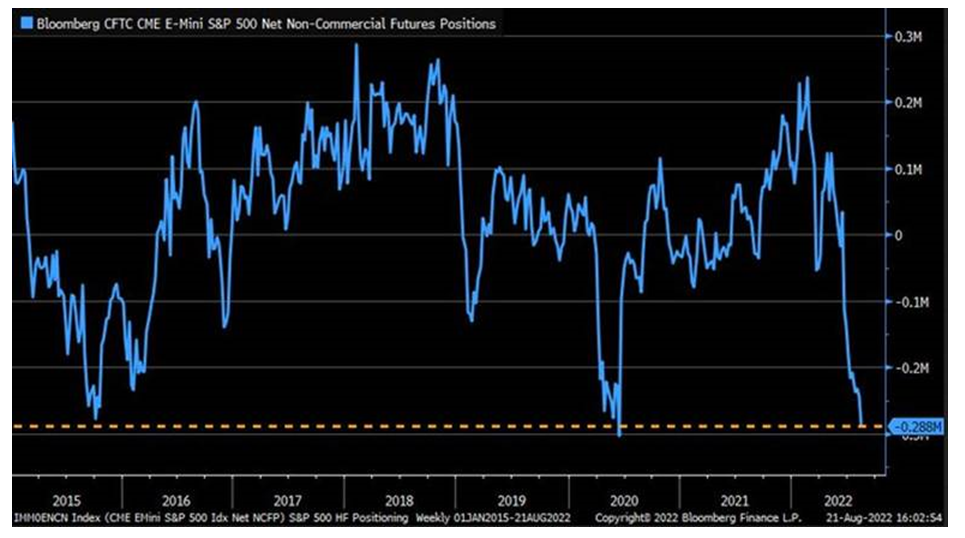

What the market ISN’T set up for is a dovish tone out of the Fed. Bearish positioning resides in both the bond and the stock markets. Net aggregate holdings of Treasuries are the lowest in four years (top chart). Hedge funds and other similar speculators are also positioned bearishly in stocks. Net aggregate holdings in SP500 futures are the lowest since AFTER we got hit with COVID in April/May 2020 (bottom chart). So, if Powell does as expected, the market is already set up to hear “tough on inflation” come from the podium…BUT…if Powell goes soft (i.e., dovish) there will be a mad scramble to cover in negative positioning on both bonds and stocks. Those short will get squeezed and but good. I expect the former, but the market clearly isn’t positioned for the latter.

I continue to believe we don’t get much of an “all clear” signal until late October/early November. By that time inflation will have fallen already by A LOT, we will have had our first frost of the season, and my beloved Boston College football team will likely be 3-6 and trending south.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.