Fed chair Powell’s folly continues. It’s quite the body of work. First problem was doing nothing in 1Q22 as inflation was rising and the Fed kept money printing/bond buying. Second problem was initiating rate hikes too little and too slow in 2Q. Now the problem is Powell talking tough and raising rates while money supply growth slows, the economy weakens and inflation cools. It’s going to be near impossible to negotiate a soft landing for the economy. Global short rates are rising, and the economy is braking hard and fast. When I was taught to do a driving three-point turn, I was taught to come in slow, measure up, and look both ways. The Fed is trying to do a three-point turn on the economy by coming in +80mph, jamming on the brakes, and spinning backwards somewhat blindfolded. That’s how accidents happen.

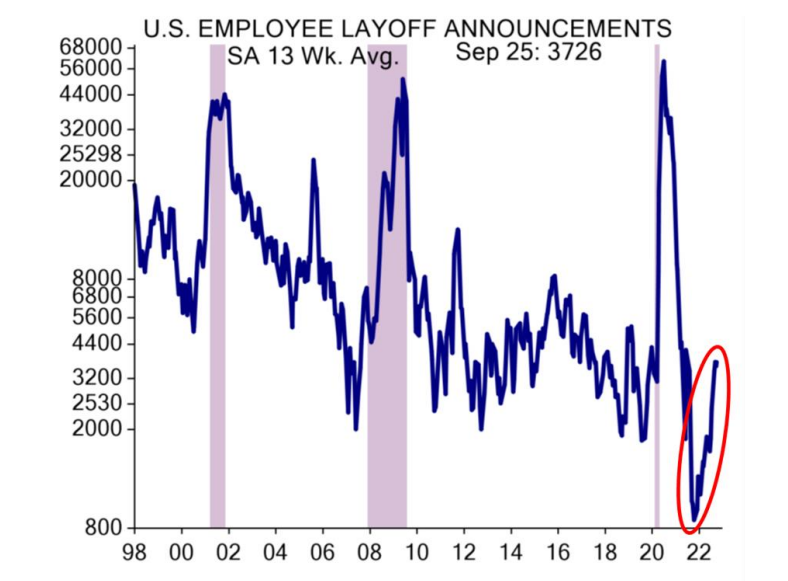

Last week’s data that the Fed did NOT talk about was the direction of rents (appear to have peaked and headed lower), money supply growth (now near zero), used car prices (down -13% from the peak), and shipping freight rates (now down -55% from the peak). The next weakness will be in the labor market. Layoff announcements on the rise. The unemployment rate is headed higher. Strangely the market doesn’t get better until a bad labor report or two cause the Fed to “pause”……but labor weakness is approaching and approaching fast.

Remain buckled up – and stay away from high yield bonds. It’s where all the defaults will occur. We’ve been away from them for a while and remain so. It’s a likely candidate for permanent loss.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.