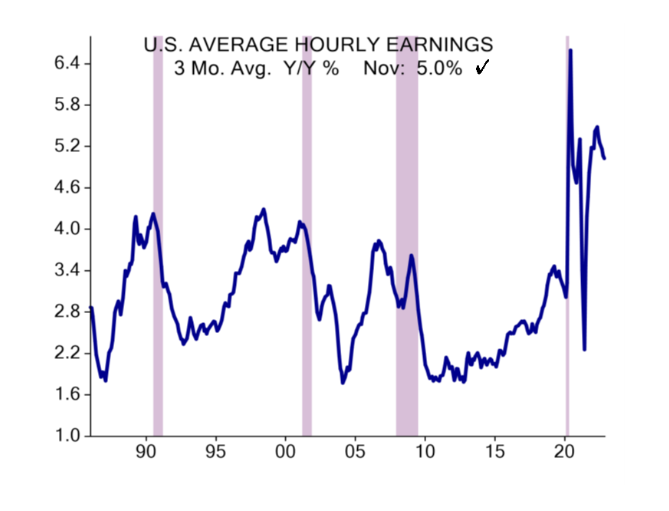

A better-than-expected jobs report this morning is sadly not what the market was/is looking for. Tough to describe this labor report as anything other than “tight”. +240k jobs after revisions for prior months, strong wage growth, low unemployment level, labor participation waning. It’s a strong jobs report across the board. In late spring 2020 we would have been dying to get such a report, but now as we attempt to exit COVID, good news means bad. Good news means the Fed is likely to continue rate hikes into Q1 2023.

Long gone are the days of “lower for longer” for the Fed with regards to rate policy. The new world might be “higher for longer”. This week’s Chicago PMI data and our own recession model are both signaling virtually 100% probability of a 2023 recession. So is a UST yield curve that’s -75 bps inverted. A lot of market damage has already happened in anticipation of such though: valuation levels for equities have experienced a major reset lower and speculation (i.e., crypto etc.) has been obliterated. What do you own to survive a recession? Quality assets. Strong balance sheets, real earnings supported by pricing power, real cash flow. It’s how we’ve been positioned and will remain positioned. Own – never rent – quality assets. They work best thru both thick and thin economies.

The Fed will likely/probably/certainly hike +50 bps in December and down shift to 25 bps in February. The silver lining is that this good labor report is likely the last (it’s strange to even type that). The significant layoffs and job cuts announced over the last 45 days will manifest themselves in the December job report. We need weakness because “bad data means good” with regards to the final months of this hiking cycle.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.