Yesterday’s reaction to dovish comments from Fed chair Powell was most certainly welcomed by the markets. Big positive moves in risk assets and lower yields across the board. This wasn’t the end but, as Winston Churchill said, perhaps the end of the beginning of this extended period of market volatility. One day doesn’t make a move, however – the market needs to follow through over the near term to confirm a trend.

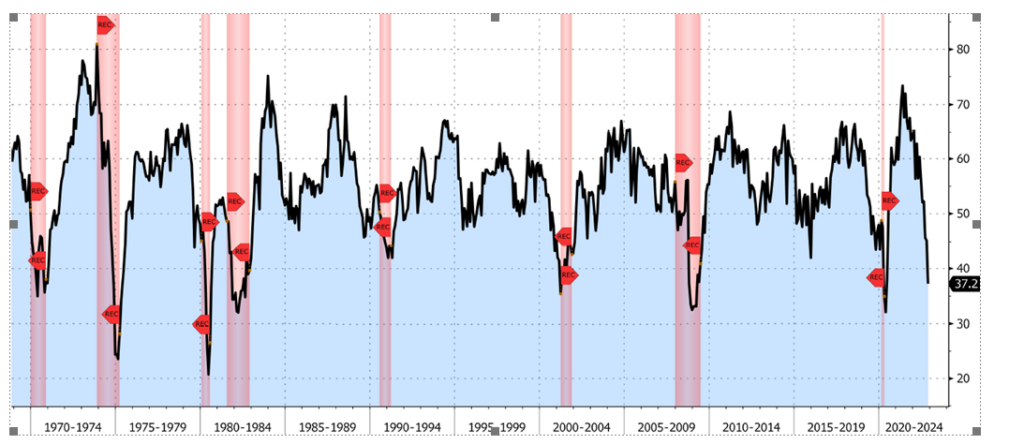

The other big story yesterday was that the market quickly shrugged off very weak Chicago PMI data. This index is a broad snapshot of industrial economic activity. A reading of >50 signals economic growth and a reading of < 50 signal economic contraction. Yesterday’s reading was an abysmal 37, the lowest reading since the darkest days of COVID in March/April 2020. Much worse than any estimates on it. The shaded pink areas in the chart below note past recessions. There’s never been a Chicago PMI reading of <45 (remember, yesterday’s was a weak 37) when the economy wasn’t either in a recession or about to be in a recession. Ultimately rate hikes do destroy demand.

Fear not, the market is a forward-looking beast and knows this info already. To really get the market going higher, the Fed needs a pivot with regards to rate policy and that pivot will likely come from a combination of lower inflation readings and weak labor data. All eyes on Friday 8:30am EST non-farm payroll report. The market would LOVE a weak report. When you get hit by a once-in-a century global pandemic, down is up, good is bad, tall is short, fat is thin etc., etc., etc.

Chicago Purchasing Managers Index

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.