The headline jobs number this morning was +223K which was roughly in line with the +200K estimate. Revisions to prior months job gains were relatively minor. Leisure and hospitality industries accounted for +67K new jobs last month while the healthcare sector added +55K. Unemployment rate stubbornly low at 3.5% but roughly 720K people reentered the workforce and that’s a good thing. We are still searching for the roughly 3.5M additional workforce participants who were in the labor force when COVID started but have since gone missing. Not a small number – but we will tackle that next week with a detailed note on the labor market and overall labor participation rates.

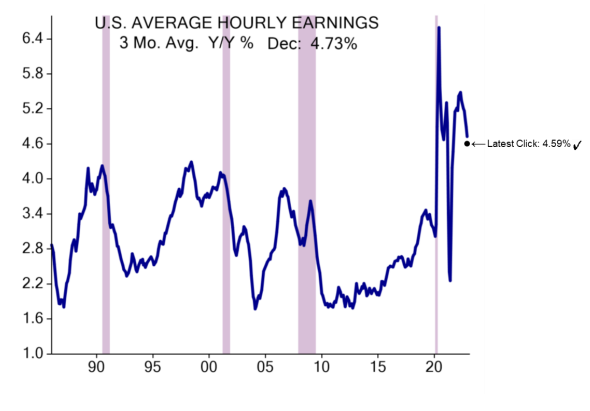

The most important thing, however, isn’t these headline numbers: it’s the trend emerging in the wage growth data. It’s slowing and not by a little. Average hourly earnings just +.3% MoM (below estimates). The workweek declined -.3% MoM (also weaker than expected) and hours worked declined -.1% MoM (also missing estimates). Tough and tight financial conditions are slowing the economy on many fronts. The super cocktail of higher Fed funds rates + quantitative tightening (Fed balance sheet shrinking) + M2 money supply cratering (money supply now growing less than when COVID started) has purposefully weakened demand, brought commodity prices down, and now is softening a very tight labor market. Like novocaine, tighter financial conditions eventually work.

The Fed will hike another 25 bps in February – but that might be it. The economy is approaching recession and while the Fed portrays itself as a nonpolitical body, everything in life is politics. EVERYTHING. The Fed is to blame for getting too far behind the market when it came to identifying and dealing with rising inflation a year ago. Fed chair Powell and Co. wont like now getting blamed for driving the economy into recession 18 months prior to presidential elections. Don’t fear a recession, embrace a recession. Investor sentiment and positioning already extremely bearish. When it comes to softening economic data, “bad” now means “good.” When the market gets a mere whiff that the Powell Pause on rates might be in the cards, it’ll rip. Just have to be there to catch it. Stay long.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.