One of the silver linings of the type of volatility that’s occurred over the past year is that it also creates opportunities amidst the carnage. An area that we believe is shaping up to be one of those opportunities is US Small Cap stocks, for several reasons.

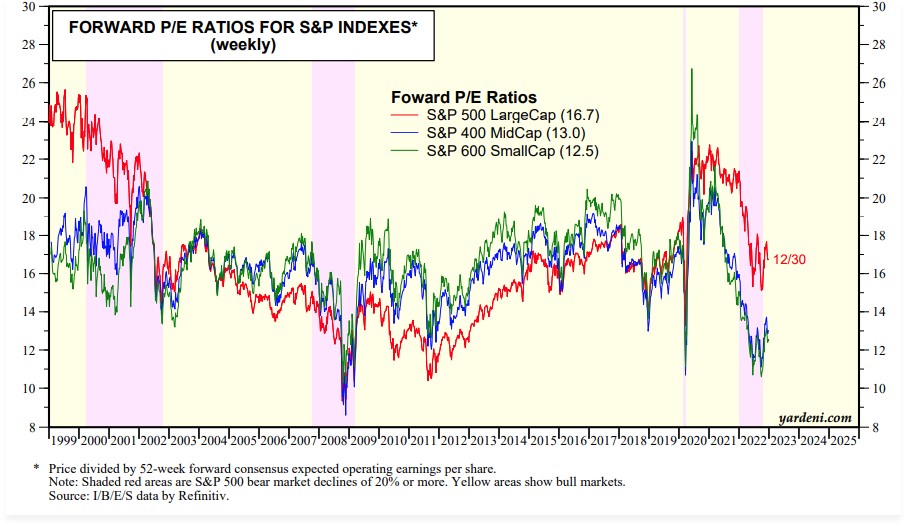

The first is that they’ve experienced an even bigger valuation “re-set” than Large Caps have in this bear market. The forward price/earnings ratio for Small Caps bottomed around 11x last year, which was similar to the level reached in the pandemic plunge and just a little above the depths of the GFC in 2008. It’s risen a little to 12.5x currently, but that’s still quite low and remains at a significant discount to Large Caps. Our own valuation model suggests this is the most attractive that Small Caps have been versus Large Caps since 2000-01.

Next, other factors that should provide a tailwind for small caps as this year unfolds are lower inflation and eventually a steeper yield curve. Inflation is already cooling, which should allow the Fed to pause its rate hiking campaign in the first few months of 2023. Once that happens, the market will start to look ahead to future rate cuts and begin to price those in (just as it priced in rate hikes last year far faster than the Fed actually moved), and the yield curve would start to re-steepen with short-term rates falling again. This would suggest the economy is passing through the nadir of its slowdown phase and soon to be entering a new growth cycle, and Small Caps happen to be early cycle performers historically.

Lastly, the composition of Small Cap indices look different in that they generally have less exposure to Growth sectors like Technology & Communication Services, and more exposure to Value sectors like Financials & Industrials. In addition, they have no exposure to the popular mega-cap stocks that have transitioned from market leaders to laggards over the past several months.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.