One of the major stories – if not THE major story – for the capital markets during 2022 was the overall tardiness of the Fed in responding to rising levels of inflation. Despite inflation spiking everywhere in late 2021/early 2022, the Fed continued to pursue a policy of accommodative quantitative easing and low rates well into 2022. A reminder that the Fed was doing QE (money printing, bond buying, drive interest rate lower) well into March of 2022 and didn’t start hiking rates until last May. During 2022, the Fed went from doing nothing to starting to hike rates slowly to commencing the fastest rate hiking cycle on record. Their goal was to bring down inflation by tightening financial conditions and destroying demand. It’s working: inflation is cooling, housing prices are going down, wage growth is softening. Eventually enough pressure on the brake mechanism does stop the car. The same can be said for an economy: the Fed’s braking is working.

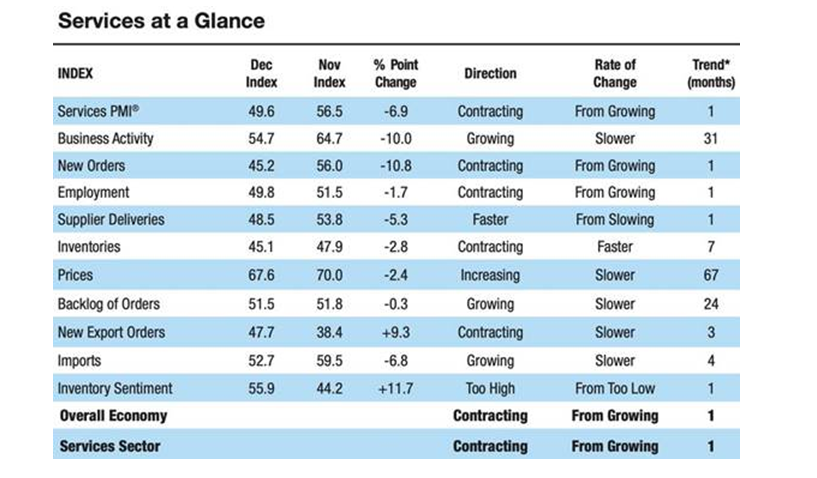

Today we can see it working in the services sector. Services PMI just dropped -7 pts in a month which is a MASSIVE fall. New orders lower, services employment softer, inventories contracting. There are likely some weather impacts included here, but you cannot ignore a -7pt drop. It’s real. We’ll know in the 2Q23 whether we were officially in a recession in 1Q23. Data lags but the impact of tighter conditions/higher rates is slowing growth and demand. Market consensus is the Fed hikes 25bps in Feb 2023 – what isn’t consensus is that might be the point at which they “pause”. I am in that camp. “Pause” = “go” for capital markets and risk assets.

Best opportunities we see in an environment in which valuation levels have reset and a new economic cycle is in the very, very early stages? All areas which have been very unpopular for the past 18-24 months. Small cap > large cap stocks, value > growth stocks, non-USA > USA, and both emerging markets and China look like they want to come out of their respective slumbers.

In the midst of volatility, opportunities always emerge.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.