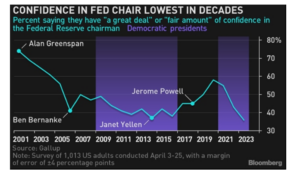

Everything is politics, including politics itself, investing, and the role of the Fed and its chair. Not really a surprise that after getting way behind inflation in late 2021/most of 2022 and embarking on the fastest/most aggressive rate hiking cycle ever, confidence in Fed chair Powell nearing historic lows. Heavy hangs the head that wears the crown.

The question that will need an answer later this year goes like this: with a recession in place, confidence in the Fed chair at historic lows, and the 2024 election season about to move into full swing, what has a greater probability of happening: additional rate hikes or the start of rate cuts?

I think we see rate cuts starting later this year.

P.S. The theatre that is the debt ceiling issue commences today. Nothing will come from these discussions and Congress will wait until the last nanosecond to cut a mediocre deal. They are 14 for 14 on that issue in the last 40 years. It’ll happen again. Kudos to Janet Yellen for pulling the drop-dead date closer. Her June 1 deadline genius will save us all from watching this circus all summer.

Source: Bloomberg data as of May 9, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.