With over 90% of companies in the S&P 500 index having already reported results, Q1 2023 earnings season is drawing to a close. Even though this was the second consecutive quarter in which earnings declined on a year-over-year basis, results have come in much better than initially expected. As of March 31st, before reporting began, the consensus estimates were pointing to an earnings decline of 6.7% compared to the same quarter last year. However, earnings reported through last Friday have exceeded estimates by a significant margin, putting them on track to come in only 2.5% lower than Q1 2022. Importantly, unlike the way the index’s return lately has been narrowly concentrated in a few mega-cap tech stocks, these positive earnings surprises were broad based across the index: 78% of companies and 10 out of 11 sectors reported better than expected earnings, and 5 out of 11 sectors reported actual positive earnings growth compared to the same quarter last year. If one needed any more evidence that the economy did not enter the much-anticipated recession in Q1, this would be it.

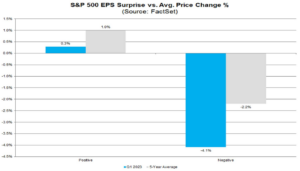

Still, investors remain on edge and are not letting themselves be carried away by these results. The market’s reaction to companies reporting positive earnings surprises has been fairly muted, with a mere 0.3% gain compared to a 1% gain on average over the last 5 years. Meanwhile, companies reporting negative earnings surprises have been punished more than usual, with a 4.1% decline compared to a 2.2% decline on average over the last 5 years. Investors’ reaction function is unlikely to change much until we manage to buckle the downtrend in forward earnings estimates and can start putting recession fears behind us. While the positive surprises of the last quarter caused estimates for the remainder of the year to tick up slightly, that is unlikely to be sustained if a recession really lies ahead. Currently, consensus estimates point to more weakness in Q2 (-6.2% YoY), followed by a recovery starting in Q3 (+0.8% YoY) and accelerating into Q4 (+8.3%). However, with a Q2 recession start date seeming increasingly unlikely as we progress through the quarter, the timeline for a recovery may need to be pushed back further towards the end of the year.

Source: FactSet, as of 5/12/2023

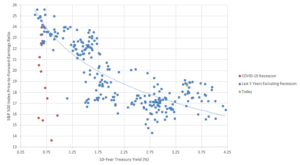

Skittish investors don’t necessarily mean that stocks are undervalued. The market is currently trading at a forward earnings multiple of roughly 18.5, which is slightly below the 5-year average but slightly above the 10-year average. Considering the current level of interest rates and an economy that refuses to stop growing, the current multiple seems approximately fair, at least relative to recent history. If (or perhaps I should say when) the economy enters recession, and especially if the recession turns out to be more severe than expected, a multiple of 18+ may seem like too much. But once the Fed starts cutting interest rates and an earnings recovery is in sight, it will suddenly seem like not enough.

Source: Congress Wealth Management, Bloomberg, as of 5/18/2023

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.