As expected, the Fed hiked +25bps yesterday and the post-hike Powell press conference was the usual bad TV it always seems to become. Inflation isn’t the problem it was six months ago. The problem is that under the Powell watch, three major financial institutions have experienced classic bank runs in the past six weeks (Silicon Valley, Signature Bank, and First Republic) and three more (PacWest, Western Alliance, and First Horizon) are getting hammered this morning. I think we will have six failures by Sunday night 6pm ET. In the past six weeks, $1 trillion of bank deposits have left the banking systems and been re-invested in money market funds. That isn’t good for small, regional banks and not good for the communities those banks serve. Local credit is contracting very, very, very quickly. And none of that will change until the Fed officially says it has “paused”. Powell should have come out and said it yesterday. He came close but sometimes you need to hear it. Volatility will remain until Powell officially pushes the “pause” button. That happening is coming and coming fast. The Powell Pause is here.

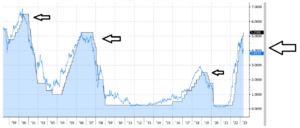

The chart below compares what the “market” thinks about short-dated interest rates and what the Fed actually has them set at. The “market” is represented by the light blue line (2Y UST as a proxy for market short rates) while the official Fed funds rate is the shaded blue area. The market usually/always leads the Fed higher and then heads lower while the Fed plateaus on rates. The Fed then eventually wakes up and heads lower on rates as data deteriorates and the economy weakens. The relationship of these two lines usually isn’t completely out of sync, but it has been since late 2021. The market got way out in front of the Fed with regards to short-dated interest rates and it took the Fed 15 months to catch up. What is happening now is the Fed looks like they want to plateau around 5% fed funds rates, but the market has already taken 2y UST rates to 3.84% and taken them there quickly. That gap is important and is to be noticed. That gap is the market telling the Fed that, once again, they are late to realizing the emerging crisis in credit and that rates need to be LOWER, NOT HIGHER.

My take on yesterday is that the PAUSE is here and that the Fed will be cutting rates by Thanksgiving. Fed chair Powell never misses an opportunity to miss an opportunity. Pause and effect.

Source: Bloomberg data as of May 4, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.