Three years ago, this week, the world was hit by the onset of the COVID pandemic. Levels of serious illness started to spike and global markets recoiled accordingly. That truly seems like a million years ago. One year ago, the war in Ukraine started. Neither of these are happy anniversaries, just anniversaries. Deutsche Bank is out this morning with two interesting charts I wanted to share.

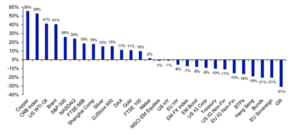

The top chart captures performance by various financial asset classes since the onset of COVID three years ago – a few observations:

- Strong performance by copper and oil/brent crude reflects the “reflation” trade working. Flood the world with cheap rates and excess stimulus and you get commodities a rippin’.

- 2022 was a tough year for every equity market but still the SP500 is up +26% over the past three years. Think about that.

- The clear laggard is fixed income/bonds in any size or shape. US high yield credit had a negative return but on a relative basis did better than anything that is more interest rate sensitive, including US investment grade debt, and US Treasuries. Longer maturity European credit (German bunds and UK gilts) got smoked.

Source: Bloomberg Finance LP, Deutsche Bank as of February 24, 2023

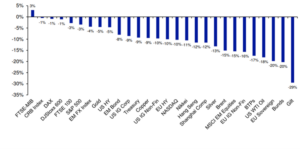

The chart below captures performance by various financial asset classes since the onset of Russia/Ukraine war one year ago. Strangely, most major European markets have done relatively well, mostly due to strong price performance since last October. In a macro environment in which global central banks have embarked on the fastest, most aggressive pace of interest rate hikes ever, there has been no place to hide.

Source: Bloomberg Finance LP, Deutsche Bank as of February 24, 2023

Conclusion: Reflecting on what has happened is interesting. Reflecting on what will happen going forward is far more important and what we do every day. This summer will probably be a summer of economic recession. Every day rates stay above >5% and the yield curve remains sharply inverted those odds go up. No one should be surprised by such – in our mind the big area of permanent loss will be in HY bonds. We’re staying clear of that. We have left a world of zero rates and now will live in a world of more normal rates (3-5%). In our minds, the best opportunities for the next 3-5 years are very different than what worked well over the past decade. Value stocks > growth stocks, cyclicals (energy, financials, industrials) over defensive sectors, and after a decade of relative underperformance we like non-US (including China) vs. US.

More than anything else, portfolios of quality holdings will be rewarded with return. Quality matters. The Age of Speculation is over.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.